Prologue: The Tale of Two Ledgers

The autumn leaves drifted across the manicured lawns of Oakwood Heights, a neighborhood where the driveways were paved with imported cobblestones and the silence was heavy with the implication of success. In the largest house on the cul-de-sac, a sprawling neo-colonial with a three-car garage, lived Marcus.

Marcus was, by every visible metric, a triumph. As a Regional Vice President for a global software firm, his salary was the kind of number that people whispered about with a mixture of envy and admiration. It was a sturdy, magnificent figure that placed him firmly in the top one percent of earners in the country. He drove a brand-new luxury SUV, leased of course, to ensure he always projected the right image to clients. His children attended the most prestigious private school in the district, and his vacations were documented in high-resolution detail on social media—skiing in the Alps, beach villas in the Maldives, and tasting menus in Tokyo. His “top line”—his revenue—was formidable.

Two streets over, in a neighborhood that bordered the wealthy enclave but didn’t quite share its zip code, lived Arthur. Arthur lived in a modest, older bungalow with a roof that had been patched twice. He was a mid-level logistics manager for a shipping company. His salary was respectable, perhaps a third of Marcus’s. He drove a five-year-old sedan that he had bought used and paid for in full. His lawn was neat, though he mowed it himself on Saturday mornings while Marcus was at the country club. To the outside observer, Arthur was average. He was invisible.

One Tuesday in November, a tremor ran through the local economy. The software firm Marcus worked for announced a “strategic restructuring” to appease shareholders. In the sterile language of corporate finance, this meant layoffs. Marcus was called into a video conference, thanked for his service, given a severance package equal to three months of pay, and disconnected from the server.

That same week, Arthur’s shipping company faced a supply chain contraction. Overtime hours were cut, and bonuses were paused indefinitely.

By January, the silence in the two homes told two very different stories.

In the bungalow, Arthur sat at his kitchen table with his wife. They opened a laptop and looked at a simple spreadsheet. They frowned at the loss of the bonus, which meant the family vacation would be a camping trip instead of a hotel stay. They decided to cook at home more often and cancel a streaming subscription they rarely used. It was annoying, certainly, but it was not catastrophic. They had “free cash flow”—money left over every month after the essential bills were paid. Because their fixed costs were low, they could absorb the blow. They slept soundly that night.

In the mansion, however, the air was thick with a suffocating panic. Marcus was drowning. Despite earning millions over the last decade, he had almost zero liquidity. Every dollar that had come in (Revenue) had immediately gone out (Expenses) to service the massive mortgage, the two luxury car leases, the private school tuition, and the credit card bills from last summer’s luxury vacation.

Marcus had fallen into the classic trap. His “Net Income” on paper had been high, but his “Cash Flow” was nonexistent. He was technically insolvent the moment the salary stopped. The severance check, which seemed like a fortune to an outsider, had been swallowed instantly by three months of back-payments on his lifestyle. He had no working capital. He had no retained earnings. He was a business that had expanded too fast, relying on perfect conditions to survive.

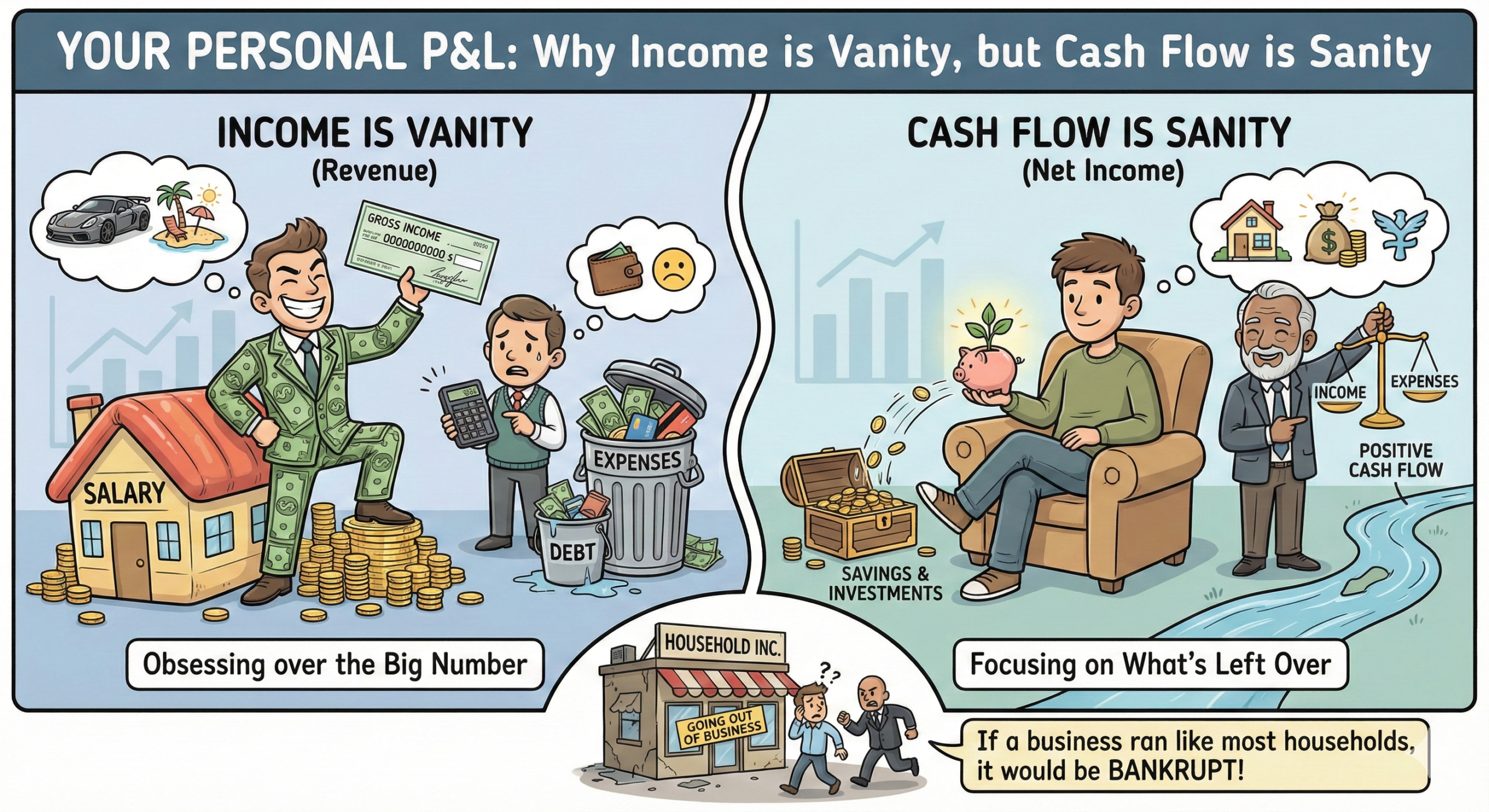

Marcus had focused on Vanity. Arthur had focused on Sanity.

This report explores why most households, like Marcus’s, are run like failing businesses, and how adopting the mindset of a ruthless Chief Financial Officer (CFO) can save you from the “profitable bankruptcy” that threatens even the highest earners. It is a guide to understanding that while income feeds your ego, it is cash flow that feeds your family.

Part I: The Revenue Trap

The Obsession with the Top Line

In the world of corporate finance, there is an enduring adage that has guided prudent investors for generations: “Turnover is vanity, profit is sanity, but cash is king”.1 This saying encapsulates the fundamental misunderstanding that plagues modern personal finance.

“Turnover,” or revenue, is the total amount of money coming into an entity. For a business, this is sales. For a household, this is your gross salary—the big number on your employment contract. It is the number we brag about at dinner parties. It is the number banks use to decide how much house we can “afford” to borrow against. It is the primary metric of social status in a capitalist society.

However, revenue is a vanity metric. It looks impressive on the surface, but it tells you absolutely nothing about the financial health of the entity. A business can sell $100 million worth of goods, but if it costs $101 million to produce, market, and deliver those goods, the business is failing. It is growing broke. Similarly, a person can earn $500,000 a year, but if they spend $505,000 to maintain the appearance of a $500,000 lifestyle, they are poorer than a student who earns $20,000 and saves $1,000.

The obsession with salary blinds us to the mechanics of solvency. We assume that a high income automatically equates to wealth. This is a dangerous fallacy. Wealth is accumulated capital—money that has been captured, retained, and deployed to earn more money. Income is merely a river flowing through your hands. If you do not build a dam (cash flow management) to catch the water, the river runs dry the moment the rain stops.

The Rise of the HENRYs

In recent years, financial analysts and marketers have coined a specific term for people who find themselves in Marcus’s position: HENRYs (High Earners, Not Rich Yet).4 These are individuals, typically earning between $250,000 and $500,000 annually, who have little to no actual wealth to show for their efforts.

The HENRY phenomenon is a paradox of the modern economy. These individuals are often highly educated, working in prestigious fields like medicine, law, or technology, yet they live paycheck to paycheck. The research indicates that HENRYs are particularly vulnerable to financial shocks because their high income masks their fragility. They often carry significant debt loads—student loans from expensive universities, maximum-limit mortgages in high-cost-of-living cities, and consumer credit used to bridge the gaps between bonuses.7

They are running their households on “projected revenue” rather than “actual cash reserves.” They bet on their future earnings to pay for their current lifestyle. If the future earnings are interrupted—by a layoff, a health issue, or a global recession—the house of cards collapses.

The HENRY demographic highlights the difference between being “Rich” and being “Wealthy.”

- Rich is a function of Income (P&L Statement). It is visible. It is the car, the clothes, the vacations.

- Wealth is a function of Net Worth (Balance Sheet). It is often invisible. It is the investment account compounding quietly. It is the debt that does not exist.

The Psychology of “More”

Why do high earners fall into this trap? Why does a raise not solve money problems? The answer lies in human psychology. The danger of a high salary is that it often triggers Lifestyle Creep, also known as Lifestyle Inflation.8

Lifestyle creep is the gradual increase in spending as income rises. It is insidious because it feels like “normalizing.” When you were a student, a shared apartment and instant noodles were normal. When you got your first job, a studio apartment and casual dining became normal. As you reached executive level, a four-bedroom house and luxury vacations became the new baseline.

This phenomenon is driven by three powerful psychological triggers:

- Hedonic Adaptation: Humans are wired to quickly adapt to new circumstances. The thrill of a new luxury—heated seats in a car, a housekeeper, a business class flight—fades rapidly. What was once a treat becomes an expectation. Once you adapt to the heated seats, driving a car without them feels like a deprivation, not a return to neutral.10 We run a “hedonic treadmill,” running faster just to stay in the same place of satisfaction.

- Social Comparison: We are social animals who determine our status by comparing ourselves to our immediate peer group. If you move into a neighborhood of high earners to “give your kids a better life,” your standard for what is “necessary” shifts. Suddenly, a private gardener, a ski trip, and brand-name clothing seem like essential expenses because “everyone else is doing it”.11 You are no longer comparing yourself to the general population; you are comparing yourself to the top 1%, and in that room, you might feel poor.

- Mental Accounting: We tend to categorize money differently based on its source. We treat a regular salary as money for bills, but we treat bonuses, tax refunds, or raises as “free money” or “play money” to be spent on rewards.10 Instead of viewing a $10,000 bonus as a chance to buy $500 of passive income for life (by investing it), we view it as a $10,000 watch.

This creates a dangerous financial structure where the “break-even point” of the household keeps rising. A household that needed $3,000 a month to survive five years ago now “needs” $10,000 a month. This rigidity makes them less adaptable to change. In business terms, they have increased their Operating Leverage—their fixed costs are so high that a small drop in revenue leads to a massive drop in profitability.

Part II: The Business of You

The Anatomy of a Business Failure

To understand how to fix a household’s finances, we must look at how businesses fail. It is a common misconception that businesses go bankrupt because they are not profitable. In reality, profitable businesses go bankrupt every day.12

How is this possible? How can a company that is making money on paper go out of business?

Imagine a company that manufactures furniture. It sells a table for $1,000. It costs $600 to make that table (materials and labor). On the Income Statement (Profit & Loss or P&L), the company shows a profit of $400. This looks like a successful, profitable business.

However, business operates on credit. The customer who bought the table might not pay the $1,000 invoice for 90 days. But the lumber supplier demands the $600 payment today. The workers demand their wages this Friday.

The company has a “profit” of $400, but it has a “cash deficit” of -$600 right now. If the company does not have cash in the bank to pay the supplier and the workers, operations stop. The supplier cuts them off. The workers quit. The business collapses.

This is called a Cash Flow Crisis. The business ran out of cash while waiting for its profit.14 The “sanity” of cash flow was ignored for the “vanity” of sales figures.

Overtrading: The Silent Killer

There is a specific type of business failure called “Overtrading”.16 This paradoxically happens when a business is growing too fast.

When a business expands rapidly, it takes on more orders. To fulfill these orders, it must hire more staff, rent more space, and buy more inventory. All of these things cost cash now. The revenue from these new orders will not arrive until later.

If the business does not have enough “Working Capital” (a cash buffer) to bridge this gap, the growth itself kills the company. They are “trading beyond their means.”

Case Study: The Bookstore Collapse

Consider the failure of major bookstore chains like Borders. While e-commerce was a factor, strategic rigidities and cash flow management played huge roles. They expanded their physical footprint (high fixed costs) and held massive amounts of inventory (cash tied up in books sitting on shelves). When sales dipped slightly, they still had to pay the rent and the suppliers. They lacked the liquidity to pivot.18

Mapping Overtrading to the Household

In a household, overtrading looks remarkably similar to the business examples, though we rarely use the term.

- The Housing Stretch: Buying a house at the very top of your mortgage approval limit is overtrading. You are expanding your “operations” (your living situation) to the maximum capacity of your current revenue. You have left no margin for maintenance, tax hikes, or interest rate increases.

- The Two-Car Trap: Financing two new vehicles because you can just afford the monthly payments is overtrading. You have committed future cash flow to depreciating assets.

- The Renovation Debt: Putting a $50,000 kitchen renovation on a credit card or a Home Equity Line of Credit (HELOC), assuming your future bonus will pay it off, is overtrading. You are spending revenue you haven’t earned yet.

In all these cases, you are expanding your “lifestyle operations” faster than your “capital reserves” can support. You are one missed paycheck away from disaster. This is why a personal P&L is not enough—you need to understand your Personal Cash Flow.

The Three Financial Statements of a Household

If you were to hire a professional CFO to take over the management of your life, the first thing they would do is stop looking at just your bank balance. A single bank balance number is misleading. Instead, they would set up three distinct financial documents. Most households only loosely track the first one and ignore the other two.

1. The Personal Income Statement (P&L)

This document measures profitability over a specific period of time (usually one month or one year).20 It answers the question: “Did we earn more than we spent?”

| Business Term | Household Term | Definition |

| Revenue (Top Line) | Gross Salary / Income | Total money earned before taxes, benefits, or deductions. |

| Cost of Goods Sold (COGS) | Essential Work Costs | Taxes, commuting costs, mandatory work clothes, union dues. |

| Gross Profit | Take-Home Pay | The money that actually hits your bank account to be used. |

| Operating Expenses (OpEx) | Living Expenses | Rent/Mortgage, food, utilities, subscriptions, school fees. |

| Net Income (Bottom Line) | Savings | What is left over (Revenue – Expenses). |

The Trap of the P&L:

2. The Balance Sheet

This document measures wealth at a specific point in time.22 It is a snapshot of your financial standing.

- Assets: What you own. This includes Cash, your House (market value), Investments, and your Car (market value).

- Liabilities: What you owe. This includes your Mortgage balance, Student Loans, Car Loans, and Credit Card balances.

- Equity (Net Worth): Assets minus Liabilities.

The Trap of the Balance Sheet: Many people are “Asset Rich, Cash Poor.” They have high Assets (a $1 million home) and high Liabilities (a $800,000 mortgage). Their Net Worth is positive ($200,000), which looks healthy. But you cannot eat your house. If you lose your job, the bank will not accept “home equity” as payment for the electric bill unless you sell the house or take on more debt.

3. The Cash Flow Statement

This is the document that saves you. It measures liquidity—the actual movement of cash in and out of your possession.23 It ignores what you “earned” and focuses on what you “received.” It ignores what you “charged” and focuses on what you “paid.”

- Operating Cash Flow: Your monthly salary received minus the bills actually paid this month.

- Investing Cash Flow: Cash spent on buying stocks or home improvements (cash out) or dividends received (cash in).

- Financing Cash Flow: Cash received from a loan (cash in) or cash used to pay down the principal of a debt (cash out).

The Sanity Check: This statement tells the absolute truth. It answers the critical question: “Do I have the money in the bank to pay the bill that is due tomorrow?”

Part III: The Strategy of Sanity

Adopting the CFO Mindset

To move from vanity to sanity, you must fundamentally shift your identity regarding your household finances. You must stop acting like a consumer and start acting like the Chief Financial Officer (CFO) of “You, Inc.”.25

In a corporation, the CEO sets the vision. They say, “We want to launch a new product” or “We want to expand into Asia.” In a household, the “CEO” is the part of you (and your partner) that dreams: “We want to retire at 55,” “We want to buy a vacation home,” or “We want to send the kids to Ivy League schools.”

The CFO’s job is not to say “no” to the vision, but to ensure the money is there to execute the vision without bankrupting the company. The CFO creates the constraints. The CFO says, “We can expand into Asia, but only if we reduce domestic operating costs by 10% first to fund it.”

In many households, the CEO is hyper-active—booking vacations, signing renovation contracts, upgrading cars—but the CFO is absent. Expenses are approved without checking the cash flow forecast.

The CFO’s Rule #1: Do Not Mix Personal and Business (Even if the Business is You)

If you are a freelancer or business owner, mixing your business funds with your personal funds is a “cardinal sin” known as commingling.27 It makes it impossible to know if the business is profitable or if the household is solvent.

But even as an employee, you should separate “Operating Cash” from “Reserve Cash.”

- Operating Account (Checking/Current): This is for monthly bills.

- Reserve Account (Savings): This is for emergencies and irregular expenses.

- Growth Account (Investment): This is for long-term wealth.

Money should flow between these accounts based on a system, not based on impulse.

Calculating Your True “Burn Rate”

Startups are obsessed with their “burn rate”—the amount of cash they spend each month just to keep the lights on and the doors open. If a startup has $100,000 in the bank and a burn rate of $10,000/month, they have a “runway” of 10 months. If they don’t make a profit or raise more money before the runway ends, they die.

What is your household’s runway?

If you and your partner lost your jobs today (Revenue drops to zero), how many months could you survive without selling your house or defaulting on debt?

- The HENRY Runway: Often 1 to 2 months. They have a high burn rate (expensive lifestyle) and low cash reserves.

- The Sanity Runway: 6 to 12 months.

To calculate this, you need to strip away the vanity expenses and look at your Operating Expenses.

- Fixed Costs: Mortgage/Rent, Insurance, Utilities, Minimum Debt Payments. These are hard to cut in a crisis.

- Variable Costs: Dining out, Entertainment, Clothing, Travel. These can be cut, but only if you have the discipline.

A “Personal P&L” statement helps you identify these. It forces a “psychological pause”.28 When you write down every expense by hand, you are forced to confront the waste. You see that the “small” $5 coffee daily is actually a $1,800 annual line item—a significant percentage of your net profit.

The Gap Between Income and Cash

One of the most dangerous traps for households is the timing gap between income and expenses.29

- Income is often received monthly or bi-weekly.

- Expenses happen daily or at irregular intervals.

A “profitable” household can bounce a check (or incur an overdraft fee) because the mortgage payment hit on the 1st of the month, but the paycheck didn’t hit until the 5th. This forces the household to use credit cards to bridge the gap.

Using credit cards to bridge a cash flow gap is like a business taking out a high-interest payday loan to make payroll. It solves the immediate problem, but it increases the “Interest Expense” line on future P&Ls, lowering future profitability. It starts a “debt spiral.”

Case Study: The “Profitable” Bankruptcy

Consider a family that earns $10,000 a month after tax. Their expenses are $9,000.

- Net Income: +$1,000 (Profitable!)

- The Shock: The water heater breaks ($2,000) on the 10th of the month.

- The Reality: They do not have $2,000 cash in the bank because they just paid the mortgage and credit card bills. They have to put the repair on a credit card at 20% interest.

- The Spiral: Next month, their expenses are $9,000 + $33 (interest). Their profit drops. If another shock happens—a car repair, a medical bill—the profit disappears entirely.

This is how a family with a “profitable” $120,000/year income ends up deep in debt. They lacked Liquidity. They focused on the $1,000 profit and ignored the cash flow timing.

The Household Liquidity Crisis

Economists warn of “household liquidity crises,” where a shock to income (recession, unemployment) leads to a rapid reduction in consumption because households cannot access their wealth.30

- Illiquid Wealth: You might have $200,000 in equity in your home. But if you lose your job, the bank will not give you a Home Equity Loan because you have no income. That wealth is locked away. You cannot buy groceries with a brick from your house.

- Liquid Wealth: Cash in a savings account is accessible immediately.

The “Sanity” approach prioritizes liquidity over pure return. It is better to have $20,000 earning 4% in a savings account (accessible) than to pay down $20,000 of a 3% mortgage (inaccessible), purely for the sake of cash flow safety.

Part IV: Escaping the Vanity Trap – A Tactical Guide

Step 1: Analyze Your Personal P&L

You cannot manage what you do not measure. The first step to becoming the CFO of your life is to create a Personal P&L Statement. You can do this on a spreadsheet or using a budgeting app, but the structure matters.20

The Structure of a Personal P&L:

- Top Line (Inflows): List all sources of income. Salary, bonuses, side hustles, dividends. Be honest—use the net amount that hits your bank, not the gross amount on your contract. The government gets paid before you do.

- Cost of Living (Outflows): Categorize these strictly.

- Need-to-haves (Fixed): Housing, basic food, utilities, transport.

- Nice-to-haves (Variable): Subscriptions, dining out, hobbies.

- Debt Service: Interest payments and principal repayments.

- The Bottom Line (Net Cash Flow): Subtract Outflows from Inflows.

The Golden Ratio: 50/30/20

A widely accepted benchmark for a healthy Personal P&L is the 50/30/20 rule 33:

- 50% of income goes to Needs (Fixed Costs).

- 30% of income goes to Wants (Discretionary).

- 20% of income goes to Savings/Debt Repayment (Profit).

If your Fixed Costs are 80% of your income, you are “Overtrading.” You have too much house or too much car for your revenue stream. You have no margin for error. You need to restructure your business—downsize the house, sell the car.

Step 2: Manage “Lifestyle Creep”

The enemy of the Personal P&L is Lifestyle Creep. It attacks the “30%” bucket (Wants) and swells it until it eats into the “20%” bucket (Savings).8

Signs you are a victim of Lifestyle Creep:

- You got a raise, but your savings account didn’t grow.

- You view luxuries (cleaner, premium cable, Uber Eats) as necessities.34

- You have stopped budgeting because “you earn enough now”.8

The Defense Strategy:

When you get a raise, hide the money.

If your salary goes up by $1,000 a month, immediately set up an automatic transfer of $800 to an investment account or savings account. Allow yourself $200 for lifestyle enjoyment. This captures the “Profit” before it can be spent on “Vanity.” This technique is often called “paying yourself first.”

Step 3: Cash Flow is King (Liquidity Management)

Profit is theory; cash is fact. You need to manage your liquidity.35

- Build a Cash Buffer: Before investing, you need a “Working Capital” fund. This is not your emergency fund. This is one month’s worth of expenses sitting in your checking/current account at all times. This smooths out the timing differences between paychecks and bills.

- The Emergency Fund (Retained Earnings): This is 3-6 months of expenses held in a separate, accessible account (like a High-Yield Savings Account). This is your insurance against the “Revenue Shock” (job loss).35

- Reduce “Accounts Payable”: High-interest debt (credit cards) is a leak in your ship. Prioritize paying this down. It is a guaranteed 20%+ return on your money to pay off a credit card.4

Step 4: The Monthly Board Meeting

Run your household like a business. Schedule a monthly “Board Meeting” with your spouse or yourself.28

- Review the P&L: Did we make a profit this month? Did we stick to the budget?

- Review the Cash Flow: Is our cash buffer intact?

- Forecast: What big expenses are coming up in the next 3 months (Car insurance? Christmas? Vacation?) and do we have the cash flow to cover them?

This transforms money from a source of anxiety into a managed resource. It replaces “I hope we have enough” with “I know we have enough.”

Part V: Insight – The Psychology of the “Rich” vs. the “Wealthy”

There is a profound difference between being “Rich” (High Income/Vanity) and being “Wealthy” (High Net Worth/Sanity).

Rich is visible. It is the car, the clothes, the Instagram photos. It is the Revenue.

Wealth is invisible. It is the money not spent. It is the investment account compounding quietly. It is the Retained Earnings.2

The reason so many people obsess over salary (Revenue) is that it is a social signal. We can see our neighbor’s new car; we cannot see their 401(k) balance. We are biologically wired to compete for status, and in the modern world, status is signaled through consumption.10

However, the “Wealthy” mindset rejects this signal. The Wealthy understand that spending money to show people how much money you have is the fastest way to have less money.

By focusing on Cash Flow and Net Income, you are playing a different game. You are playing for Freedom, not Status.

- Status is buying a luxury car that requires a $1,000 monthly lease, locking you into your high-stress job to pay for it.

- Freedom is driving a paid-off reliable car and having that $1,000 flow into an index fund, buying you the option to retire early or take a lower-paying, happier job.

Global Perspectives on Wealth Symbols

The symbols of vanity change across cultures, but the mechanism is the same.37

- In the West: The symbol is often the luxury car or the size of the home.

- In Asia (e.g., India/China): The symbol might be gold, specific jewelry brands, or property ownership.

- In the Digital Age: New symbols have emerged, like crypto-wallet balances or ownership of exclusive NFTs.

Regardless of the symbol—a gold necklace or a Tesla—if it is purchased with debt or at the expense of cash flow reserves, it is a vanity metric that endangers the sanity of the household.

The “Current Account” vs. “Checking Account”

A note for the global reader: The terminology may change, but the principle is universal.

In the US and Canada, the transactional account is a “Checking Account.” In the UK, Europe, and many Commonwealth nations, it is a “Current Account”.39

Regardless of the name, this account is the heart of your cash flow. It is the Grand Central Station of your money.

- Mistake: Letting savings sit here. Money in a current account usually earns 0% interest and is too easy to spend.39

- Strategy: Keep only your “Working Capital” here. Sweep the rest into Savings or Investments immediately.

Part VI: The Deep Dive – Why “Profit” is Sanity

Let’s look deeper into the “Sanity” aspect. Why is Net Income (Profit) the only metric that matters for mental health?

1. Predictability breeds calm.

When you live on 80% of your income (saving 20%), you have a 20% buffer against the world. If inflation goes up 5%, you are annoyed, but you are not hungry. If your rent goes up, you can absorb it. You have margin.

The person living on 100% (or 110%) of their income has zero margin. Any deviation from the plan causes chaos. Chaos breeds anxiety. Sanity comes from the buffer.

2. Compounding requires raw material.

Einstein reportedly called compound interest the “eighth wonder of the world.” But compounding only works if you have “seed capital.”

- If you earn $100,000 and spend $100,000, your investment capital is $0. $0 compounded over 30 years is $0.

- If you earn $50,000 and spend $40,000, your investment capital is $10,000. Over 30 years at 7%, that $10,000 annual savings becomes nearly $1 million.

The person with the lower salary but higher “Net Income” ends up wealthier than the high earner with zero Net Income. This is the mathematical proof that Income is Vanity.

3. The “Zombie” Household.

In business, a “Zombie Company” is one that earns just enough money to pay the interest on its debts but can never pay off the principal or invest in growth.19 They are the walking dead—one market crash away from oblivion.

Many households are Zombie Households. They make minimum payments on credit cards. They pay the mortgage interest but have no equity. They look alive (they have a house, a car, a job), but they are financially dead.

Focusing on Net Income allows you to pay down debt (De-leveraging), which brings the Zombie back to life.

Conclusion: The Tale of Two Futures

Let us return to Marcus and Arthur.

Five years after the layoff, the stories have diverged even further.

Marcus eventually found a new job, but at a lower salary. Because he refused to sell the house or the cars (Vanity), he raided his retirement accounts to pay the bills. He is now 50 years old, with zero savings, a massive tax bill for the early withdrawals, and high blood pressure. He is “working for the bank,” with every paycheck spoken for before it even arrives. He is a high-revenue, low-profit, insolvent entity.

Arthur, the “Cash Flow Master,” used the downturn to buy stocks when they were cheap. He and his wife kept their expenses low. When the economy recovered, their “Free Cash Flow” surged. They used the surplus to pay off their mortgage entirely. Now, they have almost no fixed costs. Their “Personal P&L” is a fortress. They have the freedom to travel, to help their kids, or to retire early.

Arthur understood the assignment. He ran his household like a conservative, resilient business.

The Lessons for Your Personal P&L:

- Ignore the Top Line: Your salary is just a vanity number for cocktail parties. It does not measure your success.

- Obsess over the Bottom Line: Your “Net Income” (Savings) is the only money you actually get to keep.

- Respect Cash Flow: Ensure you have liquidity. Don’t let timing gaps force you into debt.

- Avoid Overtrading: Don’t expand your lifestyle faster than your savings.

- Be the CFO: manage your household with the ruthless efficiency of a turnaround expert.

In the end, it doesn’t matter how much money flows through your hands. It only matters how much sticks. Revenue is vanity. Cash Flow is sanity.

Extended Analysis & Insights

This section provides detailed breakdowns of the concepts used in the report, offering a “second layer” of depth for the reader who wants to understand the mechanics.

1. The Mechanics of “Overtrading” in a Household

The concept of “Overtrading” is critical to understanding why HENRYs fail. In business, overtrading often creates a “Working Capital Starvation”.17

- Business Example: A company gets a massive order from Walmart. To fulfill it, they must buy $1M in raw materials now. They don’t have $1M cash. They borrow it. Walmart doesn’t pay them for 90 days. In those 90 days, the interest piles up, and they can’t pay their staff. They go bust because of their success.

- Household Parallel: A couple gets a big promotion. They immediately buy a “forever home” that requires $50,000 in furniture and landscaping now. They put it on credit. They have “booked” the future revenue (the new salary), but the cash hasn’t arrived yet. They have increased their “operating leverage.” If the job doesn’t work out, or the bonus is lower than expected, they are trapped.

Insight: The safest time to upgrade your lifestyle is after the cash is in the bank, not when the contract is signed.

2. The Nuance of Accrual vs. Cash Accounting

Most large businesses use Accrual Accounting (recording income when it is earned, not received). Most households naturally use Cash Accounting (recording income when it hits the bank).

- The Danger Zone: Credit cards trick households into using a hybrid system. We record the pleasure of the purchase (the expense) when we swipe the card, but we don’t feel the pain of the cash outflow until the bill is paid. This disconnect breaks the feedback loop that regulates spending.12

- The Fix: “Yell at your money.” Finance journaling or using apps that deduct the money from your “available balance” instantly can restore the Cash Accounting discipline.28

3. The Liquidity Hierarchy

Not all assets are created equal. A common mistake on Personal Balance Sheets is confusing “Net Worth” with “Liquidity”.30

- Cash: 100% Liquid. Can buy food today.

- Stocks/Bonds: High Liquidity (T+2 settlement). Can be sold quickly, but market risk exists.

- Real Estate: Low Liquidity. It takes months to sell a house. You cannot sell your bathroom to pay for groceries.

- Private Equity/Business: Very Low Liquidity.

Insight: A household with $2M in a house and $5,000 in cash is less resilient than a household with $500k in a house and $100k in cash. The former is “House Poor” and vulnerable to cash flow shocks.

4. Strategic “De-growth”

Sometimes, a business must shrink to survive. It sells off divisions, closes factories, and reduces headcount to restore profitability.

Households rarely consider this. We view “downsizing” as a failure.

Insight: Strategic downsizing (selling the big car, moving to a smaller apartment) is a power move. It instantly improves Free Cash Flow. It is not a retreat; it is a restructuring for future growth. It turns a “loss-making entity” back into a “profitable” one.

By viewing your life through the lens of a P&L, you gain emotional distance. You stop judging yourself for “being bad with money” and start analyzing the “business” for operational inefficiencies. It turns a moral failing into a management challenge. And management challenges can be solved.

Tables and Tools

Table 1: The Personal Financial Statement Map

Mapping Business Concepts to Your Life

| Business Concept | Personal Equivalent | The Danger | The Goal |

| Revenue (Turnover) | Salary, Bonuses, Dividends | Obsessing over this number (Vanity). | Maximize, but do not rely on it alone. |

| OpEx (Operating Expenses) | Rent, Food, Netflix, Gas | Letting these grow automatically (Creep). | Keep lower than Revenue (Sanity). |

| Net Income (Profit) | Savings Rate | Ignoring it. | Aim for >20% of Revenue. |

| Cash Flow | Checking Account Balance | Running it to zero every month. | Build a buffer (Working Capital). |

| Insolvency | Bankruptcy | Living Paycheck to Paycheck. | 6 Months of “Runway” (Emergency Fund). |

| Dividends | “Fun Money” | Spending profit before it’s earned. | Pay yourself only after savings are met. |

Table 2: The HENRY vs. The Wealthy Builder

| Metric | The HENRY (High Earner, Not Rich Yet) | The Wealthy Builder |

| Focus | Maximizing Salary | Maximizing Net Worth |

| Car | Leased Luxury SUV ($1,200/mo) | Owned Reliable Sedan ($0/mo) |

| Housing | Maximum Mortgage Approval | Well Below Means |

| Credit Cards | Used to extend purchasing power | Used for points, paid in full monthly |

| Reaction to Raise | “I can finally buy that boat!” | “I can increase my investment contributions!” |

| Financial Status | High Stress, Low Liquidity | Low Stress, High Liquidity |

Works cited

- A Sheffield Hallam University thesis, accessed December 7, 2025, http://shura.shu.ac.uk/20160/1/10699988.pdf

- The Personal MBA – by Josh Kaufman – Derek Sivers, accessed December 7, 2025, https://sive.rs/book/PersonalMBA

- MPB on bootstrapping, cash flow and building a team | Sage Advice UK, accessed December 7, 2025, https://www.sage.com/en-gb/blog/mpb-bootstrapping-cash-flow/

- Are you a High Earner, Not Rich Yet (HENRY)? Here’s what you need to know | Chase UK, accessed December 7, 2025, https://www.chase.co.uk/gb/en/hub/henry/

- Who Are High Earners, Not Rich Yet (HENRYs)? Definition and Financial Guide, accessed December 7, 2025, https://www.investopedia.com/terms/h/high-earners-not-yet-rich-henrys.asp

- The H.E.N.R.Y. Paradox: Why High Earners Stay Stuck — and How to Break Through | by Jaeneen Cunningham | Dec, 2025 | Medium, accessed December 7, 2025, https://medium.com/@jm.cunningham/the-h-e-n-r-y-paradox-why-high-earners-stay-stuck-and-how-to-break-through-d826639c8f13

- How to Stop Being a HENRY & Take Control of Your Finances – WealthKeel, accessed December 7, 2025, https://wealthkeel.com/blog/how-to-stop-being-a-henry-take-control-of-your-finances/

- The Effects of Lifestyle Creep and Ways to Manage It – SoFi, accessed December 7, 2025, https://www.sofi.com/learn/content/effects-of-lifestyle-creep/

- What is lifestyle creep and how does it work? – Fidelity Investments, accessed December 7, 2025, https://www.fidelity.com/learning-center/personal-finance/lifestyle-creep

- What is Lifestyle Creep & How to Avoid It [2025 Guide] – AdvisorFinder, accessed December 7, 2025, https://advisorfinder.com/blog-posts/what-is-lifestyle-creep-how-to-avoid-it-2025

- What The Tech Is Lifestyle Creep? – Level Up Financial Planning, accessed December 7, 2025, https://www.levelupfinancialplanning.com/what-the-tech-is-lifestyle-creep/

- The Paradox of Profitable Bankruptcy: How Companies Can Go Bankrupt While Showing a Profit – CEED, accessed December 7, 2025, https://www.ceed.ca/the-paradox-of-profitable-bankruptcy-how-companies-can-go-bankrupt-while-showing-a-profit/

- The Cash Flow Trap: Why Profitable Businesses Still Go Broke | by Mike Clark | Medium, accessed December 7, 2025, https://medium.com/@mike_clark_utah/the-cash-flow-trap-why-profitable-businesses-still-go-broke-1490f21e658b

- A trap that causes many businesses to go broke, while they’re making a profit, accessed December 7, 2025, https://www.ascentwa.com.au/blog/cash-flow-planning

- Corporate Finance Explained: Why Companies Go Bankrupt | CFI, accessed December 7, 2025, https://corporatefinanceinstitute.com/resources/finpod/corporate-finance-explained-why-companies-go-bankrupt/

- Behavioral Finance and Wealth Management: Market Anomalies, Investors’ Behavior and the Role of Financial Advisors – Virtus InterPress, accessed December 7, 2025, https://virtusinterpress.org/IMG/pdf/complete_pdf_file_of_the_book-8.pdf

- Overtrading – The Downside of Business Growth – Moula, accessed December 7, 2025, https://moula.com.au/finance/overtrading

- 10 Big Business Failures – Philip Chantry – ActionCOACH, accessed December 7, 2025, https://philipchantry.actioncoach.co.uk/2025/07/15/business-failure-examples/

- Zombie Companies: Is your business walking dead? Complete Guide for SMEs, accessed December 7, 2025, https://sklaw.au/blog/zombie-companies/

- Profit and Loss (P&L) Statement of Personal finances: Meaning & Benefits – HDFC Life, accessed December 7, 2025, https://www.hdfclife.com/insurance-knowledge-centre/investment-for-future-planning/profit-and-loss-statement-of-personal-finance

- Cash Flow vs. Profit: What’s the Difference? – HBS Online – Harvard Business School, accessed December 7, 2025, https://online.hbs.edu/blog/post/cash-flow-vs-profit

- Personal Balance Sheet | Overview, Types & Examples – Lesson – Study.com, accessed December 7, 2025, https://study.com/learn/lesson/personal-balance-sheet.html

- Free cash flow (FCF) vs. net income: Differences and how to calculate | QuickBooks – Intuit, accessed December 7, 2025, https://quickbooks.intuit.com/r/cash-flow/critical-difference-profit-cash-flow/

- Operating Cash Flow vs. Net Income: What’s the Difference? – Investopedia, accessed December 7, 2025, https://www.investopedia.com/ask/answers/012915/what-difference-between-operating-cash-flow-and-net-income.asp

- Why Running a Home Is Like Running a Business by Marcus Lemonis, accessed December 7, 2025, https://marcuslemonis.com/lifestyle/running-a-home

- Mom, the CEO: Running a Household Like a Fortune 500 Company – Pibank USA, accessed December 7, 2025, https://www.pibank.com/mom-the-ceo-running-a-household-like-a-fortune-500-company/

- Untangling Personal and Business Income/Expenses – Manager Forum, accessed December 7, 2025, https://forum.manager.io/t/untangling-personal-and-business-income-expenses/12086

- 20 Ways To Use Finance Journaling To Sharpen Spending Awareness – Forbes, accessed December 7, 2025, https://www.forbes.com/councils/forbesfinancecouncil/2025/09/24/20-ways-to-use-finance-journaling-to-sharpen-spending-awareness/

- What’s the Difference Between Cash Flow and Income? And Why Does It Matter?, accessed December 7, 2025, https://avior.com/insights/economic-and-market-commentary/whats-the-difference-between-cash-flow-and-income-and-why-does-it-matter/

- Housing values, deregulation and household savings behaviour – Reserve Bank of New Zealand, accessed December 7, 2025, https://www.rbnz.govt.nz/-/media/ReserveBank/Files/Publications/Seminars%20and%20workshops/112040/4apr02hull.pdf

- The One Simple Budgeting Method That Changed My Life – YouTube, accessed December 7, 2025, https://www.youtube.com/watch?v=N2aODJWw7Xw

- Optimize Personal Cash Flow for Financial Freedom – Paradigm Life, accessed December 7, 2025, https://paradigmlife.net/personal-cash-flow/

- How to Manage Personal Cash Flow in 2023 – Mudrex Learn, accessed December 7, 2025, https://mudrex.com/learn/how-to-manage-personal-cash-flow/

- The hidden triggers behind your spending – CommBank, accessed December 7, 2025, https://www.commbank.com.au/brighter/financial-education/the-hidden-triggers-behind-your-spending.html

- Personal cash flow management strategies – Ameriprise advisor, accessed December 7, 2025, https://www.ameripriseadvisors.com/brenda.l.dobrick/insights/personal-cash-flow-management-strategies/

- Personal cash flow management strategies – Ameriprise Financial, accessed December 7, 2025, https://www.ameriprise.com/financial-goals-priorities/personal-finance/personal-cash-flow-management-strategies

- How Symbols of Wealth Shape Cultural Narratives – Mahadi, accessed December 7, 2025, https://www.mahadi.com.pe/how-symbols-of-wealth-shape-cultural-narratives/

- The Power of Symbols: Prosperity and Rewards in Modern Design – Arrive Recovery Center, accessed December 7, 2025, https://arriverecoverycenter.com/the-power-of-symbols-prosperity-and-rewards-in-modern-design/

- What is Checking Account? Meaning, Types and Advantages. | EnKash, accessed December 7, 2025, https://www.enkash.com/resources/blog/checking-account-explained-functionality-and-benefits

- Understanding current accounts: a comprehensive guide – Online financial platform for your business needs | Genome, accessed December 7, 2025, https://blog.genome.eu/money-and-you/what-is-a-current-account/

- What is the difference between a checking account and a savings account? – Moneytrans, accessed December 7, 2025, https://www.moneytrans.eu/moneytransblog/en/current-account-vs-savings-account/