Executive Summary: The Anatomy of a Crisis

The trajectory of a career is rarely a straight line; for many, it is punctuated by abrupt, unforeseen interruptions. The loss of employment is not merely an economic event—it is a physiological, psychological, and sociological shock that disrupts the fundamental rhythms of daily life. In the immediate aftermath of a layoff, an individual is often paralyzed by the duality of the crisis: the need for immediate, decisive financial action clashes violently with the emotional paralysis of grief and uncertainty.

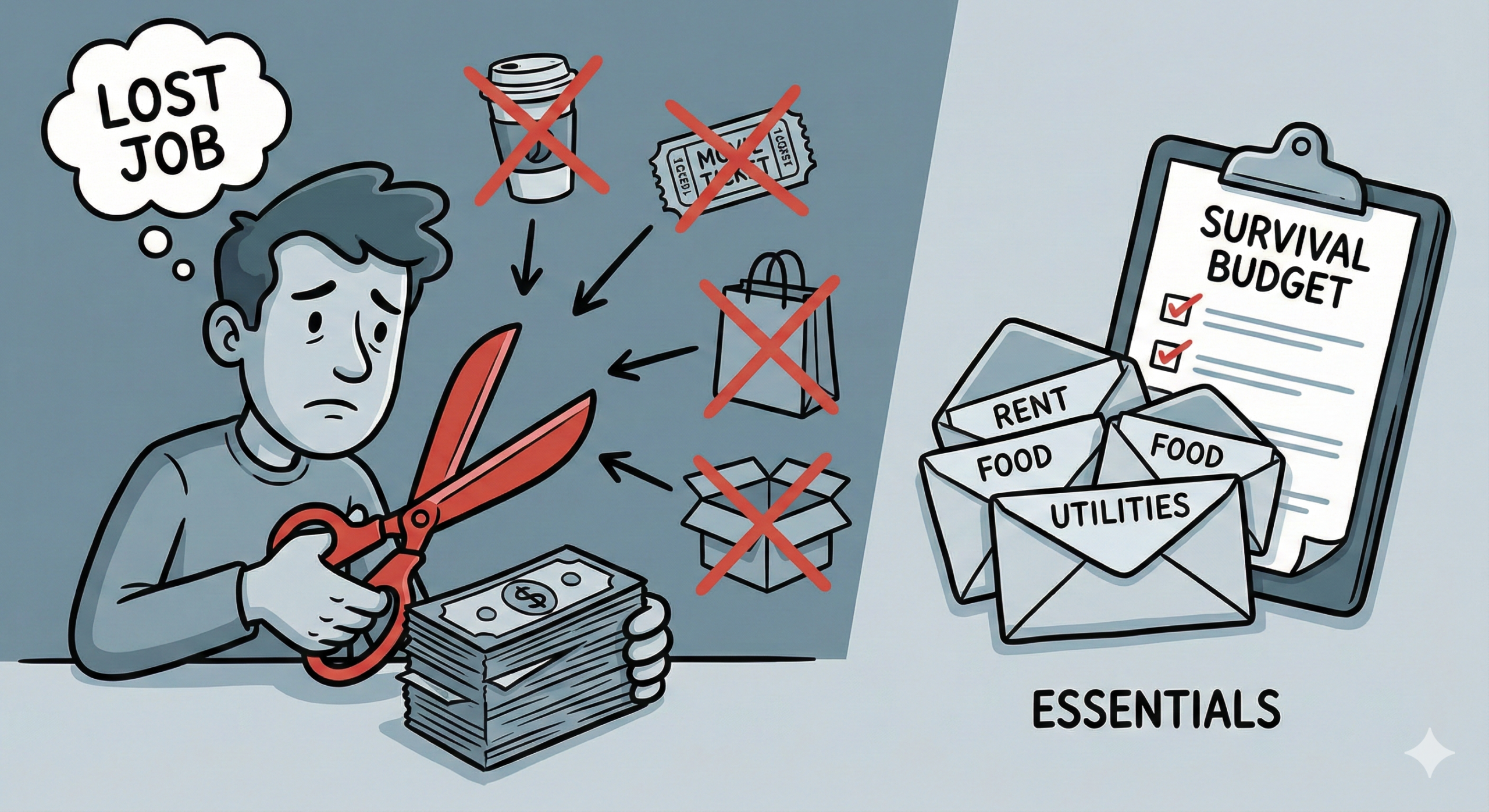

This article provides an exhaustive, granular examination of the “Survival Budget”—a specialized financial protocol designed to navigate the perilous interim between employment tenures. Unlike a standard household budget, which aims for optimization and growth, a survival budget is a defensive strategy. Its sole objective is the preservation of solvency and the protection of the “Four Walls”—Food, Utilities, Shelter, and Transportation—until income is restored.

Drawing upon behavioral economics, debt management strategies, global poverty data (ALICE thresholds), and psychological research into job loss grief, this document serves as a tactical manual. It synthesizes expert advice on negotiating with creditors, restructuring caloric intake for cost-efficiency, managing the psychological burden of frugality, and leveraging the gig economy for bridge income.

Part I: The Narrative of Disruption

The Day the Music Stopped

Marcus sat in the ergonomic chair that had been his “throne” for the past three years, the hum of the open-plan office usually a comforting white noise. Today, however, the silence in the glass-walled conference room was deafening. Across the table, the Department Head, a woman Marcus had shared lunch with just last week, refused to meet his eyes. The HR representative, a stranger with a compassionate but practiced expression, slid a thick envelope across the mahogany surface.

“Restructuring.” “Redundancy.” “Effective immediately.”

The words floated in the air, abstract and sterile, detaching Marcus from his reality. He thought of the notifications on his phone: a calendar reminder for a project due Thursday, a text from his wife about dinner plans, an automated alert that his gym membership fee had just cleared. In the span of ten minutes, the architecture of his life—his income, his routine, his identity—had been dismantled.

Walking out of the building with a single cardboard box containing a potted succulent and a few framed photos, Marcus felt the physical weight of the envelope in his hand. It contained a severance package, details on COBRA health insurance, and legal waivers. But it didn’t contain the answer to the question screaming in his mind: How do we survive this?

That evening, the denial set in. He ordered a premium pizza, opened a bottle of wine he had been saving, and told himself it would be fine. He was skilled. The market was strong. He’d have a new role in a week. But as the wine faded and the digital clock on the bedside table blinked 3:14 AM, the “Ostrich Effect” began to crack. He remembered the mortgage payment due in twelve days. The car lease. The credit card balance from their summer vacation. The math didn’t care about his optimism.

The next morning, Marcus sat at his kitchen table, not with a resume, but with a spreadsheet. He remembered the advice of his grandfather, a man who had raised four children during a recession: “When the harvest fails, you don’t feast on the seed corn.” Marcus realized he couldn’t live his normal life while hoping for a new job. He had to construct a fortress around his remaining resources. He had to build a Survival Budget.

He wrote four words at the top of the page: Food. Utilities. Shelter. Transportation.

“Everything else,” he whispered to the empty room, “is gone.”

Part II: The Psychology of Economic Trauma

The Emotional Stages of Job Loss

To implement a survival budget effectively, one must first navigate the psychological minefield of unemployment. Behavioral economists and psychologists agree that job loss triggers a grief cycle remarkably similar to bereavement.1 Understanding these stages is critical because financial mistakes are often made not out of ignorance, but out of emotional distress.

1. Shock and Denial

In the immediate aftermath, the brain protects itself from trauma by rejecting the reality of the situation. This is the “Pizza Phase” Marcus experienced. Spending habits often continue unchanged because acknowledging the need to cut costs feels like admitting defeat. This stage is financially dangerous; every dollar spent on “normalcy” is a dollar stolen from future survival.1

2. Anger and Blame

As denial fades, anger often takes its place. This can manifest as rage against the former employer, the economy, or oneself. In this phase, “revenge spending” becomes a risk—purchasing luxury items to prove that “they can’t break me” or to maintain a façade of success for peers.2

3. Bargaining and Anxiety

This is the stage of “what ifs.” If I just work on my resume for 12 hours a day, I’ll get a job tomorrow. Anxiety peaks here. The “Ostrich Effect” is common—individuals may stop opening mail or checking bank balances because the sensory input of debt is too overwhelming to process. This avoidance can lead to missed payments and compounded financial penalties.1

4. Depression and Detachment

The loss of routine and social contact can lead to isolation. In this stage, motivation to cook (a key money-saving tactic) drops, leading to increased spending on convenience foods. The lethargy can also delay the filing of unemployment benefits or the cancellation of subscriptions.3

5. Acceptance and Reorientation

This is the operational phase. The individual accepts the new reality: I am currently unemployed, and my job is to manage my resources. Only when this stage is reached can a rigorous Survival Budget be implemented effectively. The goal of this article is to accelerate the transition from Shock to Acceptance.1

The Danger of Social Isolation

A critical, often overlooked aspect of the survival budget is the social cost. Professional identity is deeply entwined with personal worth in many cultures. When employment ceases, individuals often withdraw from their social circles to avoid the shame of inability to pay for social activities (dinners, drinks, events).

However, isolation exacerbates the crisis. Research suggests that social networks are the primary vehicle for re-employment. Furthermore, isolation removes the potential for “collaborative frugality”—community-based resource sharing. A survival budget must therefore include a strategy for low-cost socialization (e.g., potlucks, park visits) rather than total withdrawal. The narrative that one must face economic hardship in solitary confinement is a fallacy that leads to deeper depression and longer unemployment durations.4

Part III: The Architecture of the Survival Budget

Defining the Protocol

A survival budget is not a tool for wealth accumulation; it is a tool for time dilation. Every unit of currency in your possession represents a unit of time. If your monthly burn rate is $4,000 and you have $12,000 in liquid assets, you have three months of survival time. If you can compress that burn rate to $2,000, you have doubled your survival time to six months. This extra time provides the leverage to find the right employment rather than accepting a predatory or unsuitable offer out of desperation.6

The core philosophy of the survival budget relies on a ruthless prioritization framework known as the “Four Walls.” Popularized by financial experts like Dave Ramsey, this framework dictates that before any creditor, subscription, or lifestyle preference is addressed, four absolute necessities must be secured.7

The Four Walls Framework

- Food: Strictly defined as groceries and basic nutrition.

- Utilities: Lights, water, heat, and essential communication.

- Shelter: Rent or mortgage payments to maintain physical safety.

- Transportation: The means to attend interviews and procure food.

Everything falling outside these walls—credit card payments, student loans, entertainment, gifts, travel—is classified as “non-essential” and is subject to immediate suspension or cancellation.9

Table 1: The Four Walls Priority Matrix

| Priority Rank | Category | Essential Definition | Non-Essential (Cut Immediately) |

| 1 | Food | Basic groceries, pantry staples, baby formula. | Restaurants, takeout, alcohol, premium brands, coffee shops. |

| 2 | Utilities | Electricity, water, heating (to safety levels), basic internet. | Cable TV, multiple streaming services, high-speed gaming internet tiers. |

| 3 | Shelter | Mortgage/Rent, HOA fees (if critical), property tax. | Renovations, furniture, decor, storage units, gardening services. |

| 4 | Transport | Fuel for interviews, basic insurance, repairs for safety. | Car payments on luxury vehicles (sell/downgrade), road trips, premium fuel. |

The ALICE Threshold and Global Context

The concept of a survival budget is supported by data from the ALICE (Asset Limited, Income Constrained, Employed) project. The ALICE “Household Survival Budget” calculates the actual cost of basic necessities in specific counties and regions, often revealing that the “poverty line” is drastically lower than the actual cost of survival.12

In a global context, what constitutes “survival” varies, but the friction is universal.

- United States: Health insurance is a major component of the survival budget due to the lack of universal coverage.

- United Kingdom/Australia/Canada: While healthcare is largely covered, housing costs and energy bills often consume a higher percentage of the survival budget.13

- Developing Economies: The survival budget often hinges on food security and informal labor markets rather than formal debt obligations.15

Part IV: Deep Dive – Wall One: Food Security

The Pantry Challenge and Inventory Management

The first step in securing the Food Wall is to stop spending entirely. Most households possess a “hidden inventory” of calories stored in freezers and pantries. The “Pantry Challenge” dictates that no new groceries are purchased until this existing inventory is exhausted. This can delay the first cash outflow for food by one to three weeks.4

- Mechanism: Conduct a physical audit of all food in the house. Categorize by proteins (canned tuna, frozen chicken), carbohydrates (pasta, rice), and vegetables (canned corn, frozen peas).

- Creative Construction: The goal is nutrition, not gastronomy. Strange combinations (e.g., pasta with canned chili) are acceptable if they preserve cash.

The “Meatless” Dividend

Globally, animal protein is often the most expensive component of a home-cooked meal. Shifting to a plant-based or “flexitarian” diet is one of the most effective ways to slash grocery bills.

- Financial Impact: Replacing 1lb of ground beef ($5-$8) with 1lb of dry lentils ($1.50) yields a similar protein content for a fraction of the cost.

- Implementation: Adopting “Meatless Mondays” or limiting meat consumption to weekends can reduce the monthly food budget by 20-30%.16

Strategic Grocery Procurement

When the pantry is empty and shopping becomes necessary, behavioral discipline is required.

- The List is Law: Impulse spending is the enemy. Marketing psychology in supermarkets is designed to trigger desire. A strict list acts as a shield against these triggers.7

- Generic Migration: Brand loyalty is a luxury tax. Generic or store-brand products are often manufactured in the same facilities as premium brands. Switching to generics can save 25-40% on the total bill.

- The Bottom Shelf: Supermarkets place high-margin items at eye level. The most cost-effective ingredients (bags of dry rice, bulk flour, canned goods) are typically located on the bottom shelves.9

- Salvage and Discount Stores: In the US, stores like Aldi or “scratch and dent” grocers offer significant savings. In the UK/Europe, apps like “Too Good To Go” allow users to purchase unsold food from restaurants at steep discounts.16

Part V: Deep Dive – Wall Two: Utilities and Infrastructure

The War on “Energy Vampires”

Modern homes are filled with devices that draw power even when “off”—televisions in standby, computers in sleep mode, chargers left in outlets. These “energy vampires” can account for 10-20% of a household’s electricity usage.

- Action: Physically unplug devices not in use. Use power strips with on/off toggles to cut power to entertainment centers completely.6

Thermal Discipline

Heating and cooling are the largest variable expenses in the utility category.

- Water Heating: Lowering the water heater temperature to 120°F (49°C) is sufficient for all sanitary needs and significantly reduces energy consumption.

- Ambient Temperature: Adjusting the thermostat by just 2-3 degrees (wearing a sweater in winter, using fans in summer) can result in substantial monthly savings.16

The Telecommunications Negotiation

Internet access is a utility in the job-search era, but high-speed access is often a luxury.

- Negotiation Strategy: Contact providers immediately. Use a specific script: “I have recently become unemployed and need to reduce my bill to the absolute minimum to avoid cancellation. What hardship plans or lower-tier packages are available?”

- Retention Offers: Service providers have “retention departments” authorized to offer discounts to prevent customer churn. They would often rather accept a lower monthly payment than lose the account entirely.20

Part VI: Deep Dive – Wall Three: Shelter and Housing Stability

Housing is the most rigid expense and the one with the highest stakes. Loss of shelter makes re-employment nearly impossible due to the lack of a fixed address for applications and the psychological trauma of homelessness.

Renters: The Preemptive Strike

Landlords are business owners who generally prefer cash flow continuity over vacancy. A vacancy costs a landlord marketing fees, cleaning costs, and lost rent.

- Timing: Do not wait until the rent is late. Approach the landlord immediately upon job loss.

- Negotiation Levers:

- The Deposit: Ask to use the security deposit to cover the next month’s rent.

- Labor Exchange: Offer to perform maintenance, painting, or groundskeeping in exchange for a rent reduction.

- Amortization: Request to pay 50% now and amortize the remaining 50% over the next six months of the lease.21

- Global Context: In cities like Dubai, where rent is often paid in post-dated cheques, negotiation must happen before the cheque is presented to the bank to avoid criminal liability for bounced payments.24

Homeowners: Mortgage Forbearance

Banks and mortgage lenders have formal hardship programs, often strengthened after the 2008 financial crisis and the COVID-19 pandemic.

- Forbearance: This allows a borrower to pause or reduce payments for a set period (e.g., 3-6 months). The missed payments are not forgiven but are usually added to the end of the loan term or due as a lump sum upon sale or refinancing.

- Mechanism: The homeowner must contact the “Loss Mitigation” department. Ignoring the bank leads to foreclosure; communicating leads to assistance.25

The Relocation Option

If the job market prognosis is grim (e.g., a 6-12 month search is expected), staying in a high-cost living arrangement may be mathematical suicide.

- Downsizing: Moving to a smaller apartment, taking on a roommate, or moving in with family. While emotionally difficult, preserving capital by eliminating the largest expense category is the most powerful move in a survival budget.9

Part VII: Deep Dive – Wall Four: Transportation

The Cost of Mobility

Cars are often liabilities masquerading as assets. They require fuel, insurance, maintenance, and registration fees regardless of utilization.

- The Two-Car Trap: For multi-vehicle households, parking one car is an immediate savings. Cancel the collision insurance on the parked vehicle (switching to “comprehensive” or “storage” only) to save on premiums.6

- Public Transit: If reliable transit exists, it is invariably cheaper than vehicle ownership. The cost per mile of a personal vehicle (including depreciation) is significantly higher than a bus or train fare.12

Selling the Liability

If a vehicle has a high monthly payment (lease or loan), it is a drain on the survival budget. Selling the vehicle to eliminate the payment and purchasing a cheap, reliable “beater” with cash (if equity allows) frees up hundreds of dollars in monthly cash flow.

- Global Insight: In many European and Asian cities, the survival budget can eliminate the car entirely due to robust infrastructure. In the US and Australia, the car is often essential for the “Four Walls” (getting food), making this a harder cut.12

Part VIII: The “Danger Zone” – Cutting Discretionary Spending

Once the Four Walls are secured, every other expense falls into the “Danger Zone.” These are the expenses that feel essential due to habit but are, in fact, optional.

The Subscription Purge

We live in an era of “Subscription Creep.” Small monthly fees ($10 here, $15 there) accumulate into a substantial drain.

- The Audit: Review the last 12 months of credit card statements. Identify all recurring charges: streaming services (Netflix, Disney+), digital storage, subscription boxes, gym memberships, app subscriptions.

- The Action: Cancel them all. Not “pause”—cancel. The library offers free books, movies, and internet. YouTube offers free exercise classes. The outdoors is free. Re-subscribing later is easy; keeping them “just in case” is a leak in the lifeboat.4

The “Latte Factor” and Social Spending

Dining out is the most obvious yet most difficult habit to break.

- The Math: A daily $5 coffee and a $12 lunch equals roughly $350-$400 per month. This amount could cover a significant portion of a utility or insurance bill.

- Social Replacement: Instead of meeting friends at a bar or restaurant, propose a hike, a walk in the park, or a coffee at home. True friends will understand the “fiscal fasting” required during unemployment.4

Clothing and Personal Care

In a survival budget, the clothing budget is zero. Unless a specific item is required for safety (e.g., steel-toed boots for a gig job), no new clothes are purchased. Personal care involves using up the half-empty bottles in the back of the cabinet before buying new ones. Haircuts and beauty treatments are deferred or done at home.29

Part IX: Debt Management and Creditor Negotiation

The most stressful component of the survival budget is deciding who not to pay.

The Hierarchy of Obligations

When resources are insufficient to cover all outflows, a hierarchy must be enforced.

- Secured Debt (Four Walls): Mortgage/Rent and Car Payments. Losing these assets threatens physical safety and employability.

- Unsecured Debt: Credit cards, personal loans, medical bills, student loans. These creditors have no immediate mechanism to seize assets. They can call, write letters, and damage credit scores, but they cannot evict you tomorrow.10

The Scripted Negotiation

Silence triggers automated collection algorithms. Communication triggers human intervention (sometimes). Contact creditors before a payment is missed.

Script A: Credit Card Hardship

“Hello, I am calling to inform you that I have recently become unemployed. I am currently experiencing financial hardship. I cannot make my full payment this month. I would like to enroll in your hardship program. Can you freeze my interest rate or waive late fees while I seek employment?”.25

Script B: Medical Bill Negotiation

“I am currently unemployed and cannot pay this bill in full. I am reviewing my expenses. Can I apply for your charity care program? If not, I can offer a settlement of [X]% of the total bill today, or I can set up a payment plan of $20 per month.”.30

The Hardship Letter

For mortgage lenders and formal creditors, a written “Hardship Letter” is often required to trigger assistance programs. This document must be concise, factual, and propose a solution.

Table 2: Hardship Letter Template

| Section | Content Requirement |

| Header | Name, Account Number, Address, Date. |

| The Event | Clearly state: “I lost my job on due to.” Do not over-explain or be emotional. |

| The Impact | “This has resulted in a [X]% reduction in my household income.” |

| The Request | “I am requesting a for the next [Number] months.” |

| The Plan | “I am actively seeking employment and intend to resume full payments once income is restored.” |

| Documentation | Attach termination letter or unemployment benefit approval as proof. |

27

Part X: Income Bridges and The Gig Economy

A survival budget is a defensive measure (cutting costs), but it must be paired with an offensive measure (generating cash).

Unemployment Insurance and Benefits

This is the first line of defense. It is not charity; it is an insurance policy paid for through payroll taxes.

- Immediate Action: File immediately. Bureaucratic delays are common. In the US, this is state-dependent. In the UK, Universal Credit applications should be lodged instantly. In Australia, Centrelink claims take time to process.5

- Maximization: Ensure all dependents are listed to maximize the benefit amount.

The Gig Economy as a Bridge

While searching for a “career” job, a “bridge” job can keep the lights on. The gig economy offers low-barrier-to-entry options.

- Platforms: Uber, Lyft (transport); DoorDash, GrubHub (delivery); TaskRabbit (labor); Upwork, Fiverr (freelance skills).

- Economics: Be wary of the hidden costs of gig work (fuel, wear and tear on vehicles). Freelancing skills (writing, coding, design) usually offers a better margin than asset-based gig work (driving).35

Liquidating Assets

The average household contains thousands of dollars in unused items.

- Inventory: Electronics, designer clothing, musical instruments, sporting goods.

- Channels: eBay, Facebook Marketplace, Poshmark, Gumtree.

- Psychology: Selling possessions can be painful, but in a survival scenario, a guitar on the wall is less valuable than two weeks of groceries.20

Part XI: Global Perspectives on Survival

The implementation of a survival budget varies significantly by geography due to differences in social safety nets.

The United States

The US survival budget is characterized by high healthcare risk. The loss of employment often means the loss of insurance.

- Strategy: The Affordable Care Act (ACA) Marketplace considers job loss a “Qualifying Life Event,” allowing enrollment outside standard windows. Subsidies are often available based on the new, lower income. This is critical to prevent medical bankruptcy.5

The United Kingdom & Europe

With the National Health Service (NHS) and similar systems, the medical risk is lower. However, the cost of energy and housing is often higher relative to income.

- Strategy: Council Tax Reduction schemes and housing benefits are key levers to pull in the UK. The emphasis is on navigating the welfare state bureaucracy rather than private insurance markets.14

Australia

The system allows for “mortgage holidays” and superannuation (retirement) access in extreme hardship, though the latter is a last resort due to long-term compounding losses.

- Strategy: Engaging with the Australian Taxation Office (ATO) and Centrelink is the primary step.12

Global Financial Hardship Data

World Bank and WHO data indicate that financial hardship is often driven by “Catastrophic Health Spending” (spending >10% of household budget on health). In countries without universal coverage, the Survival Budget must prioritize a health emergency fund above almost all else.15

Part XII: Conclusion – The Return to Stability

The Marcus Outcome

Three months into his unemployment, Marcus had not yet found a Director-level role, but he was no longer panicking. He had secured a forbearance on his mortgage, freeing up $2,000 a month. He had sold his second car and his high-end watch, creating a cash buffer. He was cooking simple, nutritious meals using lentils and rice. He had picked up freelance consulting work on Upwork, which covered his utility bills and basic food costs.

He wasn’t living the life he had before. He was living a smaller, tighter life. But he was safe. The “Survival Budget” had done its job: it had bought him time. It prevented a temporary setback from becoming a permanent catastrophe.

Final Recommendations

The Survival Budget is a temporary state of emergency. It is uncomfortable, restrictive, and demanding. However, it is the only reliable mechanism to navigate the storm of unemployment.

- Immediacy: Speed is the most important variable. Cut costs today, not next month.

- Communication: Hide nothing from your family or your creditors. Transparency builds trust and unlocks assistance.

- Prioritization: The Four Walls (Food, Utilities, Shelter, Transport) are the only non-negotiables. Everything else is expendable.

- Resilience: Use the time bought by frugality to invest in the job search and skill acquisition.

By treating the household budget as a fortress to be defended rather than a resource to be consumed, you can weather the period of unemployment and emerge on the other side—perhaps with fewer possessions, but with your financial foundation intact.

Appendix: Resource Tables

Table 3: Creative Frugality & Substitution Guide

| Expense Category | Standard Habit | Survival Substitution | Estimated Monthly Savings |

| Food | Dining out / Takeout | Meal Prep / “Pantry Challenge” / Meatless Meals | $300 – $600 |

| Coffee | Daily Starbucks ($5/day) | Home Brew / Thermos | $100 – $150 |

| Gym | Membership ($50-$100) | Running / YouTube Calisthenics / Community Centers | $50 – $100 |

| Cleaning | Brand Name Sprays | Vinegar & Water / Baking Soda | $10 – $20 |

| Entertainment | Movies / Concerts | Library / Public Parks / Board Games | $50 – $200 |

| Clothing | Seasonal Shopping | Wear what you own / Mending | Variable |

Table 4: Global Unemployment Resources

| Region | Primary Benefit Agency | Key Program Names | Action |

| USA | State Dept. of Labor | UI (Unemployment Insurance), SNAP (Food), TANF | File online immediately. |

| UK | DWP (Dept. Work & Pensions) | Universal Credit, JSA (Jobseeker’s Allowance) | Apply via gov.uk. |

| Australia | Services Australia | JobSeeker Payment, Rent Assistance | Contact Centrelink. |

| Canada | Service Canada | EI (Employment Insurance) | Submit ROE (Record of Employment). |

1

Works cited

- Grief Counseling for Career Loss and Job Loss Support – Grief Support Center, accessed November 23, 2025, https://www.griefsupportcenter.com/job-and-career-loss

- Grief Support Center | Grief Therapy, Counseling & Coaching, accessed November 23, 2025, https://www.griefsupportcenter.com/

- Practitioner’s Guide to RAPID RESPONSE | Virginia Career Works, accessed November 23, 2025, https://virginiacareerworks.com/wp-content/uploads/Practitioners-Guide-to-Rapid-Response-2015-1.pdf

- Managing Your Money – Layoff Survival Budget … – The Layoff Lady, accessed November 23, 2025, https://www.thelayofflady.com/blog/managing-your-money-layoff-survival-budget-goals

- How to Survive Financially After a Job Loss – Better Money Habits, accessed November 23, 2025, https://bettermoneyhabits.bankofamerica.com/en/taxes-income/how-to-survive-financially-after-job-loss

- Saving After Job Loss: How To Manage Your Finances – Gainbridge, accessed November 23, 2025, https://www.gainbridge.io/post/saving-after-job-loss

- The Four Walls of Budgeting: Building a Strong Financial Foundation, accessed November 23, 2025, https://www.chiefonline.com/the-four-walls-of-budgeting-building-a-strong-financial-foundation/

- What Are the 4 Walls of a Budget? – Ramsey, accessed November 23, 2025, https://www.ramseysolutions.com/budgeting/4-things-you-must-budget

- How To Combat Inflation and Protect Your Four Walls – Ramsey Solutions, accessed November 23, 2025, https://www.ramseysolutions.com/budgeting/how-to-combat-inflation

- Dave Ramsey: If You Can’t Pay All Your Bills, Focus On These ‘Four Walls’ First | Nasdaq, accessed November 23, 2025, https://www.nasdaq.com/articles/dave-ramsey:-if-you-cant-pay-all-your-bills-focus-on-these-four-walls-first

- What Are The Four Walls? | Budgeting For Beginners | Dave Ramsey Inspired – YouTube, accessed November 23, 2025, https://www.youtube.com/watch?v=iQlAO2dlAeg

- Supporting Late-Shift Workers – American Public Transportation Association, accessed November 23, 2025, https://www.apta.com/wp-content/uploads/APTA_Late-Shift_Report.pdf

- FAIRFIELD COUNTY – Data Haven, accessed November 23, 2025, https://www.ctdatahaven.org/sites/ctdatahaven/files/DataHaven_FairfieldCounty_Community_Wellbeing_Index_2019.pdf

- IAMA person who moved to a foreign country with no job, no language skills, no serious connections, and no plan and turned it into the best thing that ever happened in my life. – Reddit, accessed November 23, 2025, https://www.reddit.com/r/IAmA/comments/i3cq8/iama_person_who_moved_to_a_foreign_country_with/

- World Bank and WHO: Half the world lacks access to essential health services, 100 million still pushed into extreme poverty because of health expenses, accessed November 23, 2025, https://www.who.int/news/item/13-12-2017-world-bank-and-who-half-the-world-lacks-access-to-essential-health-services-100-million-still-pushed-into-extreme-poverty-because-of-health-expenses

- What are you BIGGEST savers, with least effort? : r/Frugal – Reddit, accessed November 23, 2025, https://www.reddit.com/r/Frugal/comments/1jjq7ek/what_are_you_biggest_savers_with_least_effort/

- What radical steps have you taken to save money when times were tight? – Reddit, accessed November 23, 2025, https://www.reddit.com/r/AskOldPeople/comments/1extr46/what_radical_steps_have_you_taken_to_save_money/

- 16 Ways to Cut Costs: Strategies for Reducing Expenses – Debt.org, accessed November 23, 2025, https://www.debt.org/advice/how-to-cut-expenses/

- 10 ways to cut expenses by 10% – Fidelity Investments, accessed November 23, 2025, https://www.fidelity.com/learning-center/personal-finance/how-to-cut-expenses

- Five Ways to Help Manage Your Finances After a Job Loss | Huntington Bank, accessed November 23, 2025, https://www.huntington.com/learn/budgeting/managing-finances-after-job-loss

- How To Negotiate Your Rent (And Why You Should) – Chatelaine, accessed November 23, 2025, https://chatelaine.com/living/budgeting/negotiate-rent-faq/

- Can we negotiate rent prices? : r/sandiego – Reddit, accessed November 23, 2025, https://www.reddit.com/r/sandiego/comments/14rj17h/can_we_negotiate_rent_prices/

- Negotiating a rent decrease : r/Frugal – Reddit, accessed November 23, 2025, https://www.reddit.com/r/Frugal/comments/fre787/negotiating_a_rent_decrease/

- How to negotiate rent and lease terms as a US expat in Dubai | Business Insider Africa, accessed November 23, 2025, https://africa.businessinsider.com/local/markets/how-to-negotiate-rent-and-lease-terms-as-a-us-expat-in-dubai/gpxz07h

- Financial Survival After a Job Loss | First National Bank, accessed November 23, 2025, https://www.fnb-online.com/personal/knowledge-center/protect-whats-important/financial-survival-after-a-job-loss

- What to do after losing a job: How to navigate job loss – Ameriprise Financial, accessed November 23, 2025, https://www.ameriprise.com/financial-goals-priorities/personal-finance/what-to-do-after-losing-a-job

- Sample Financial Hardship Letter Date Your Name Your Address Your City, State, and Zip Loan # To (Lender/Servicer), accessed November 23, 2025, https://financialcounseling.lssmn.org/sites/financialcounseling/files/Hardship%20Letter%20Sample%20final%20pdf%20version.pdf

- 6 Ways to Reduce Your Personal Expenses and Spending – Truist Bank, accessed November 23, 2025, https://www.truist.com/money-mindset/principles/budgeting-by-values/reducing-your-expenses

- How to Prepare for a Job Loss – Protect Your Finances – Money Fit, accessed November 23, 2025, https://www.moneyfit.org/how-to-guides/life-events/how-to-prepare-for-a-job-loss/

- 11 effective debt collection call script samples with real examples – Prodigal, accessed November 23, 2025, https://www.prodigaltech.com/ltblogs/11-effective-debt-collection-call-scripts-with-real-examples

- How to Negotiate with Lenders – Equifax, accessed November 23, 2025, https://www.equifax.com/personal/education/debt-management/articles/-/learn/debt-negotiation-with-lenders/

- Financial Hardship: Sample Letter to Creditor | The Maryland People’s Law Library, accessed November 23, 2025, https://www.peoples-law.org/financial-hardship-sample-letter-creditor

- Sample Hardship Letter | ACCC Cancer, accessed November 23, 2025, https://www.accc-cancer.org/docs/projects/Financial-Advocacy/fan-sample-hardship-letter

- Hardship Letter to Creditors, accessed November 23, 2025, https://www.106rqw.ang.af.mil/Portals/7/images/Family%20Readiness/Sample%20Hardship%20letter.pdf?ver=2017-02-19-005313-317

- Gig Economy Job Strategies | Towson University, accessed November 23, 2025, https://www.towson.edu/careercenter/internships-jobs/finding-job/gig-economy.html

- Understanding the Gig Economy: Flexible Jobs Explained – Investopedia, accessed November 23, 2025, https://www.investopedia.com/terms/g/gig-economy.asp

- Best Gig Jobs in 2026: Top Side Hustles and Remote Gigs – Upwork, accessed November 23, 2025, https://www.upwork.com/resources/best-gig-economy-jobs

- What is the gig economy and what’s the deal for gig workers? – The World Economic Forum, accessed November 23, 2025, https://www.weforum.org/stories/2024/11/what-gig-economy-workers/

- Incapacity Benefits and Pathways to Work – Parliament UK, accessed November 23, 2025, https://publications.parliament.uk/pa/cm200506/cmselect/cmworpen/616/616iii.pdf

- I don’t care about money and I don’t want to work for it. I only want to work for fulfilment and survival. What should I do? – Quora, accessed November 23, 2025, https://www.quora.com/I-don-t-care-about-money-and-I-don-t-want-to-work-for-it-I-only-want-to-work-for-fulfilment-and-survival-What-should-I-do

- Publication: Global Monitoring Report on Financial Protection in Health 2021 – Open Knowledge Repository, accessed November 23, 2025, https://openknowledge.worldbank.org/entities/publication/30e5cec5-023d-593e-8452-bd14ee2f1db3