The Golden Cage: A Tale of Two Architects

The elevator doors chimed with a polite, expensive-sounding ping, opening directly into the penthouse lobby. Elias adjusted his tie in the mirrored reflection of the steel doors. It was a new tie, silk, imported from Italy. It cost more than his first car payment. But that was fine. Elias was a Senior Partner now. He made the kind of money his father used to whisper about with wide eyes.

He stepped out and walked toward his apartment door—Unit 4402. The “02” line had the best view of the harbor. When he first moved in three years ago, just after his first big promotion, the view had taken his breath away. He remembered standing by the floor-to-ceiling glass, feeling like a king surveying his kingdom.

Tonight, however, as he unlocked the heavy oak door and stepped onto the marble floors, he didn’t feel like a king. He felt a familiar, tightening knot in his stomach. It was the end of the month.

The apartment was silent, save for the hum of the climate-controlled wine fridge—another purchase he had justified as a “networking necessity.” On the kitchen island, a sleek slab of quartz, lay a small stack of envelopes. He didn’t need to open them to know what they were. The credit card bill. The lease payment for the German sedan parked downstairs. The membership dues for the exclusive gym he hadn’t visited in six weeks.

Elias walked to the fridge and poured himself a glass of sparkling water. He sat down and pulled up the calculator app on his phone. He typed in his monthly income. It was a huge number, a number that should have meant freedom. Then he started subtracting.

Minus the rent (which had gone up). Minus the car lease (he had upgraded to the sport package last year). Minus the student loan payments (which he was paying the minimum on, because “cash flow” was tight). Minus the dining out (partners don’t bring lunch). Minus the weekend trip to the vineyard (social obligation).

He hit the “equals” sign.

The number on the screen was terrifyingly small. $200.

After ten years of hard work, two degrees, three promotions, and a salary that had tripled, Elias had two hundred dollars left over at the end of the month. He was arguably “rich” on paper, but in reality, he was broke. He was running on a golden treadmill, sprinting faster and faster just to stay in the exact same spot.

Just then, his phone buzzed. It was a text from Sarah, a junior architect he mentored. She sat in a cubicle, not a corner office. She drove a five-year-old hatchback. She wore clothes from the outlet mall.

“Hey Elias! Thanks for the advice on the project. Also, just wanted to share—I finally hit my first $100,000 in savings! Dinner on me next week?”

Elias stared at the screen. Sarah made half his salary. How? How did she have $100,000 in the bank while he was worrying about a $200 surplus?

The answer wasn’t luck. It wasn’t magic. It was a simple, invisible force that had consumed Elias’s life while Sarah had managed to tame it. It was a phenomenon economists and psychologists call “Lifestyle Creep.” And unlike the buildings Elias designed, this structure was built to collapse.

Chapter 1: The Invisible Thief

Defining the Creep

What happened to Elias is not unique. It is a global epidemic among high earners. The phenomenon is formally known as Lifestyle Creep, or sometimes “Lifestyle Inflation”.1 It is the tendency for your spending to rise at the same rate—or even faster—than your income.

Imagine your finances are a gas. Your income is the container. In physics, gas expands to fill whatever container it is in. If you get a bigger container (a raise), the gas (expenses) naturally expands until it hits the walls again. You never actually feel like you have “extra” space.

This is different from normal inflation. Normal inflation (economic inflation) is when the price of milk goes from $2 to $3 because the value of money dropped. You have no control over that. Lifestyle creep is personal inflation. It is when you stop buying the $2 milk and start buying the $6 organic almond milk because you “can afford it now”.4

The tragedy of lifestyle creep is that it feels good while it is happening. It feels like success. When Elias moved into the penthouse, it felt like a reward for his hard work. When he leased the luxury car, it felt like a necessary tool for his image. But financially, these decisions were leaks in his boat. As his boat got bigger, the leaks got bigger too.

The “Broke” High Earner

Statistics show a startling reality: earning more money does not automatically lead to saving more money. In the United States, savings rates have plummeted even as incomes have risen for many sectors. In the 1970s, people saved over 10% of their income. Today, that number often hovers below 5%, and during boom times, it can drop even lower.6

This creates a class of people who are “HENRYs”—High Earners, Not Rich Yet. They have high cash flow but low net worth. They are one lost job or one medical emergency away from financial ruin, despite the designer clothes and the luxury cars.7

Why does this happen? The research points to a few key culprits:

- Social Pressure: The need to fit in with a new, wealthier peer group.

- Emotional Spending: Using money to celebrate or cope with the stress of the higher-paying job.

- Lack of Planning: Assuming that because there is more money, there is enough money, and therefore stopping the budget.1

For Elias, the trap was set the day he got his offer letter. He saw the new salary and immediately calculated what he could buy with it, not what he could save with it. He mentally spent the money before it even hit his bank account.

The Global Nature of the Problem

This is not just an American problem or a Western problem. It is a human problem.

- In the UK: It often manifests as “upsizing” the house. A raise means moving to a postcode with a “better reputation,” which comes with higher taxes and heating bills.9

- In India and Southeast Asia: It often shows up in “status consumption.” Young professionals in Mumbai or Bangalore might spend their raises on the latest smartphones, branded watches, or frequent dining at high-end cafes to signal they have “made it”.10

- In Australia: It might be the “ute” (utility vehicle) upgrade or the renovation of the patio for entertaining.1

No matter where you live, the human brain is wired to consume resources when they become available. Our ancestors lived in a world of scarcity. If they found a fruit tree, they ate the fruit immediately because it might rot or be stolen. Today, we still have that “eat it now” instinct, but our “fruit” is a paycheck, and “eating it” means buying things we don’t need.

Chapter 2: The Psychology of “More”

To understand why Elias failed and Sarah succeeded, we have to look inside their heads. The math of personal finance is simple (spend less than you earn), but the psychology is incredibly difficult. Three powerful psychological forces were working against Elias from the moment he got his promotion.

Force 1: The Hedonic Treadmill

The most powerful force driving lifestyle creep is Hedonic Adaptation.7

Here is how it worked for Elias:

When he drove his old hatchback, his happiness level with his commute was a 5 out of 10. It was just a car. When he leased the luxury German sedan, his happiness spiked to a 10. The leather smelled amazing. The sound system was crisp. The engine roared. For about three months, every time he got in the car, he felt a rush of joy.

But human beings are designed to adapt. We get used to things. By month four, the leather seats were just “seats.” The quiet cabin was just “silence.” The car wasn’t a luxury anymore; it was just his car. His happiness dropped back down to a 5.

This is the Hedonic Treadmill. You run hard (spend money) to get a boost of happiness, but the treadmill moves beneath you, and you end up right back where you started.13 To get that “10 out of 10” feeling again, Elias can’t just drive his current luxury car. He needs a better one. Maybe a Porsche?

This cycle never ends. There is always a better car, a bigger house, a nicer watch. If you rely on spending to make you happy, you have to keep spending more and more just to feel “normal.” Sarah, on the other hand, understood this. She kept her old car. She knew that a new car would only make her happy for a short time, but the money in the bank would give her security forever.

Force 2: The Diderot Effect

The second force is named after a French philosopher named Denis Diderot. The story goes that Diderot lived a simple life until he was gifted a beautiful, expensive scarlet robe.14

He loved the robe. But when he wore it in his study, he noticed that his old desk looked trashy compared to the magnificent robe. So, he bought a new mahogany desk. Then, he noticed the rug looked tattered next to the new desk. So, he bought a luxury rug. Then the paintings on the wall looked cheap.

Within a year, Diderot had replaced everything in his room to “match” the robe. He was entirely broke. He wrote an essay regretting the day he got the robe, calling himself a slave to his luxury.

This is the Diderot Effect: buying one new thing creates a spiral where you feel pressured to buy more things to match the first thing.16

Elias fell into this trap perfectly.

- The Robe: The new Penthouse Apartment.

- The Desk: His old IKEA furniture looked terrible in the new apartment. He “had” to upgrade to designer furniture.

- The Rug: He couldn’t serve cheap wine in a designer apartment. He “had” to buy the wine fridge and stock it with expensive bottles.

Sarah avoided the Diderot Effect by refusing the first upgrade. By staying in her modest apartment, her IKEA furniture still fit perfectly. She didn’t trigger the chain reaction.

Force 3: Social Comparison (The Joneses)

The third force is the oldest in the book: Keeping Up with the Joneses.18

Humans are social animals. We determine our social standing by looking at the people around us.

- When Elias was a junior architect, he compared himself to other juniors. They all drove used cars and ate sandwiches. He felt normal.

- When he became a Senior Partner, his peer group changed. Now he was surrounded by people who wore custom suits, vacationed in the Maldives, and drove luxury cars.

Suddenly, Elias felt “poor” even though he was richer than ever. To feel like he belonged in the tribe of Senior Partners, he had to mimic their spending. He had to wear the right watch. He had to drink the right scotch.

This is dangerous because spending is visible, but wealth is invisible.8

Elias could see his colleagues’ cars. He could not see their bank accounts. For all he knew, they were just as broke as he was. (And statistically, many of them probably were). He was copying their bad habits because they looked like success.

Sarah, however, practiced what some now call “Loud Budgeting” or simply not caring. She defined her status not by what she bought, but by what she knew she had. She opted out of the status game.

Force 4: Mental Accounting

The final psychological trick is Mental Accounting.7 This is how our brains categorize money differently depending on where it comes from.

- Salary: We view this as “serious money” for bills and rent.

- Raise/Bonus: We view this as “extra money” or “play money.”

When Elias got his $30,000 raise, his brain labeled it as “winnings.” It felt like free money. Therefore, he felt justified in spending it on treats (the car, the clothes).

The problem is, once you sign a lease for a car, that “play money” becomes a “fixed expense.” It moves from the “fun” category to the “obligation” category. But Elias had already mentally spent it.

Chapter 3: The Mathematics of the Trap

Now, let’s look at the numbers. Psychology explains why Elias did it, but the math explains exactly how much it cost him. The damage is far worse than just the monthly bill. It is about the destruction of Compound Interest.

The Cost of the Car

Let’s analyze Elias’s decision to lease the luxury sedan.

- Cost: $600 per month.

- Duration: He leases a new one every 3 years. He does this for his 30-year career.

- Total Spent: $600 x 12 months x 30 years = $216,000.

That sounds like a lot. But the real cost is what that money could have done if he had been like Sarah.

The Sarah Scenario:

Sarah keeps driving her paid-off hatchback. She takes that same $600 a month and invests it in a standard index fund (like the S&P 500) that earns an average of 7% per year.

- Year 1: She saves $7,200.

- Year 10: She has roughly $100,000. (This is where she is now).

- Year 20: She has roughly $300,000.

- Year 30: She has roughly $700,000.

Compare the two outcomes:

- Elias: Has driven a nice car for 30 years. Owns nothing (the leases ended). Net worth impact: -$216,000.

- Sarah: Has driven an okay car. Owns $700,000 in cash.

The difference isn’t just the cost of the car. It is the Opportunity Cost. By spending the raise, Elias didn’t just spend the money; he killed the “money babies” that his money would have produced. He destroyed his future freedom for a heated seat.21

The Inflation Double-Whammy

We mentioned earlier that lifestyle creep is “personal inflation.” But we must also remember “real inflation.”

Over time, the cost of living goes up naturally. Bread gets more expensive. Gas gets more expensive.

- If Elias’s lifestyle expenses rise by 3% due to regular inflation, AND…

- His lifestyle expenses rise another 10% because of lifestyle creep (buying better stuff)…

- He is fighting a battle on two fronts.

Calculators often show that you need about 70-80% of your pre-retirement income to live comfortably in retirement. But if Elias keeps inflating his lifestyle, his “income need” gets higher and higher.

- If he lived on $50,000, he needs a portfolio of roughly $1.25 million to retire.

- If he inflates his lifestyle to live on $150,000, he needs a portfolio of $3.75 million to retire.

By spending his raise, he is doing two things:

- He is preventing his savings from growing (by spending the cash).

- He is moving the finish line further away (by needing more money to sustain his fancy life).

He is walking backward on a moving walkway. No wonder he feels like he can never stop working.5

Chapter 4: The 50/50 Rule – The Golden Ratio

Elias sat in his kitchen, the calculator app still open showing his pathetic $200 surplus. He felt hopeless. He couldn’t just sell everything tomorrow; he had contracts, leases, and an image to maintain. Was it too late?

Then he remembered Sarah’s text. “$100,000 saved.”

He swallowed his pride and texted her back. “What’s your secret?”

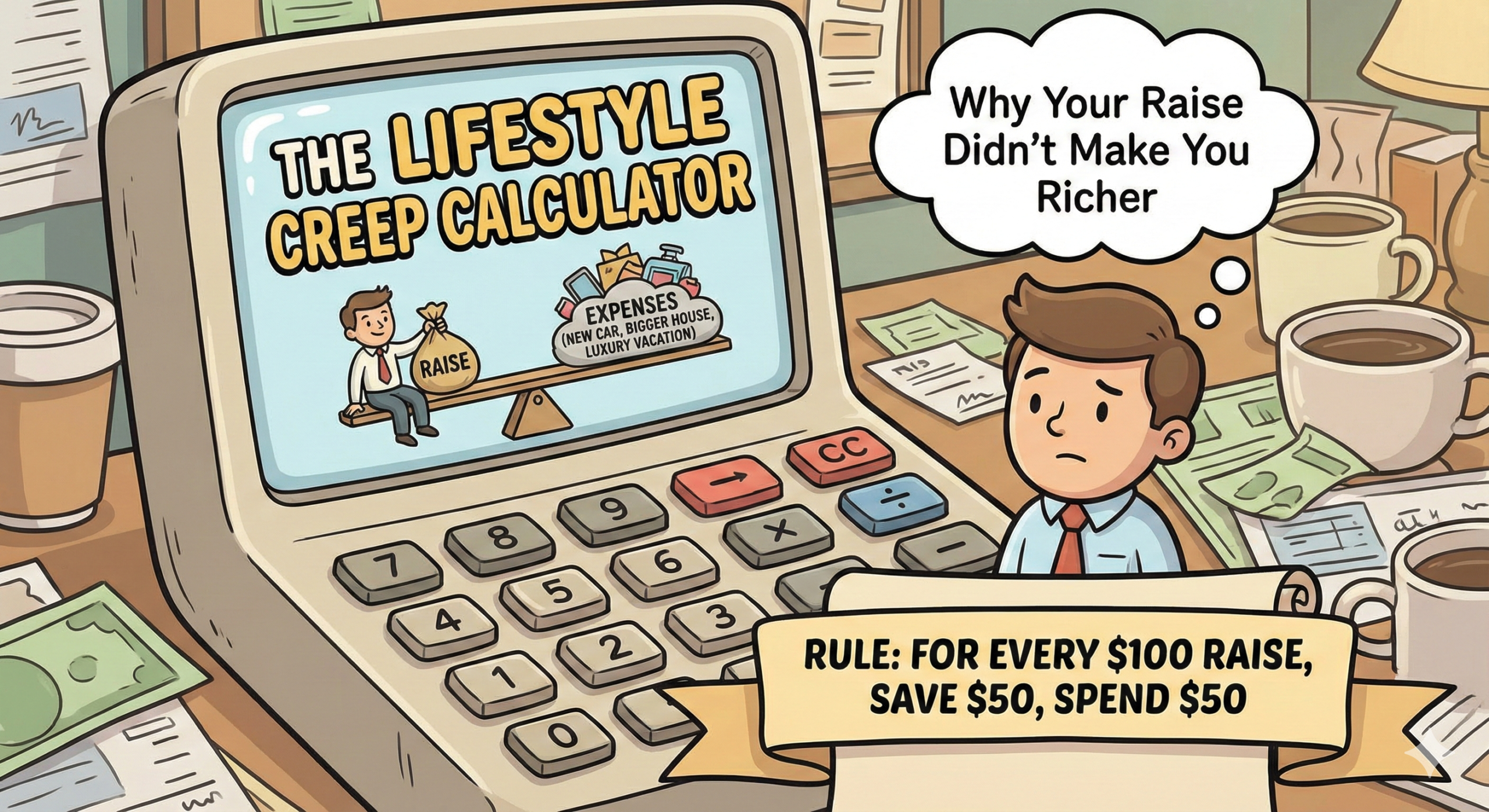

Her reply came instantly. “The 50/50 Rule. For every raise, save half, spend half.”

This is the core solution to lifestyle creep. It is simple, mathematical, and psychologically sustainable. It is championed by financial experts like “The Money Guy” show and behavioral economists.21

What is the 50/50 Rule?

The rule states: Every time your take-home pay increases (a raise, a bonus, a new job, or a side hustle), you must split the new money down the middle.

- 50% goes to the Past or Future: Paying down debt (Past) or investing for retirement (Future).

- 50% goes to the Present: Improving your lifestyle (Creep).

Why it works for the Brain (Psychology)

Most financial advice fails because it relies on deprivation. If you tell Elias, “Save 100% of your raise, don’t buy anything nice,” he will fail. He works hard. He wants to feel the reward. If he feels deprived, he will eventually “binge spend” out of frustration.

The 50/50 rule gives him permission to spend.

- “Yes, Elias, you can get a nicer car. But only using half the raise.”

- “Yes, you can buy the expensive suit. But only using half the raise.”

This satisfies the Hedonic urge. He gets a dopamine hit. He feels like he is moving up in the world. But because he is also saving the other half, he is building a safety net.26

Why it works for the Wallet (Math)

Let’s look at the numbers if Elias had used this rule 3 years ago.

The Scenario:

- Starting Pay: $4,000/month take-home.

- Expenses: $3,500/month.

- Savings: $500/month (Savings Rate: 12.5%).

The Raise: Income jumps to $7,000/month (Increase of $3,000).

Applying the 50/50 Rule:

- New Money: $3,000.

- Save 50%: $1,500 is added to savings.

- Spend 50%: $1,500 is added to lifestyle.

The New Reality:

- New Savings: $500 (base) + $1,500 (new) = $2,000/month.

- New Lifestyle: $3,500 (base) + $1,500 (new) = $5,000/month.

The Magic Result:

Elias is now living a much better life (spending $5,000 instead of $3,500). He has a nicer apartment and nicer clothes. He does not feel poor.

BUT… his savings rate has skyrocketed.

- He is now saving $2,000 on a $7,000 income.

- His savings rate went from 12.5% to 28%.

He tricked himself into becoming a super-saver without ever feeling like he was cutting back. This is the power of the rule. It automatically increases your savings rate with every promotion.21

Chapter 5: The Implementation Guide

Elias realized that he had messed up. He had spent 100% (or maybe 110%) of his raise. He couldn’t go back in time. But he was due for a year-end bonus in two months. He decided to create a battle plan.

If you are a high earner feeling broke, or a young worker anticipating a raise, here is the step-by-step guide to installing the 50/50 rule into your life.

Step 1: The Audit (Where is the leak?)

You cannot fix what you do not measure.

- Action: Look at your last 3 months of spending. Categorize every expense into “Fixed” (Rent, Car) and “Variable” (Food, Shopping).

- Identify the Creep: Spot the subscriptions you don’t use. Spot the recurring costs that bring you no joy.

- The “Latte Factor” Globalized: In the digital age, creep is often small and frequent. It’s the Spotify subscription, the Netflix, the Hulu, the Amazon Prime, the Gym, the specialized app for meditation. Each is $10. Together they are $100. This is “Death by a Thousand Cuts”.27

Step 2: The Firewall (Automation)

The most critical step is to remove willpower from the equation.

Behavioral research shows that willpower is a depletable resource. If you have to decide to save money every month, you will eventually fail, especially when you are stressed or tired.

- Action: Set up an automatic transfer.

- The “Pay Yourself First” Method: Configure your bank account so that the day after payday, the 50% savings portion is automatically moved to a separate account (brokerage or savings). Ideally, this account should be at a different bank so you don’t see it when you log in to check your checking balance.

- Why it works: If the money isn’t there, you can’t spend it. You will naturally adjust your spending to match the remaining balance. This uses Parkinson’s Law (“Work expands to fill the time available”) in your favor: “Expenses will contract to fit the cash available”.4

Step 3: Managing the “Joneses” (Social Defense)

This is the hardest part. How do you say “no” to the expensive dinner with colleagues?

- Strategy: Loud Budgeting. Be honest. “I’d love to go, but I’m maxed out on my fun budget for the month.” Ironically, confidence in saying “no” often signals higher status than saying “yes” to everything.

- Strategy: The 48-Hour Rule. For any physical purchase over $100 (a new watch, a new gadget), force yourself to wait 48 hours. Put it in the online cart, but don’t click buy. 90% of the time, the dopamine craving fades after two days, and you realize you don’t actually want it.4

Step 4: The Reverse Diderot (Downgrading)

If you are already deep in the hole like Elias, you might need drastic measures.

- Action: Identify the “Head Pin” luxury item that is causing the other costs. For Elias, it was the apartment. The apartment demanded expensive furniture and expensive habits.

- The Hard Choice: Elias realized he couldn’t sustain the 4402 lifestyle. He couldn’t break the lease immediately, but he could plan to move to a cheaper unit in the same building when the lease was up. He could trade in the lease on the German sedan for a reliable, purchased vehicle. It would hurt his ego temporarily, but it would save his life permanently.

Chapter 6: Global Variations of the Creep

While the math is universal, the flavor of lifestyle creep changes depending on where you are in the world.

The United Kingdom & Australia: The Property Ladder Trap

In the UK and Australia, the obsession with home ownership drives the creep.

- The Mechanism: A raise isn’t spent on cars; it’s used to qualify for a larger mortgage. People stretch themselves to the absolute limit of what the bank will lend.

- The Consequence: They end up “House Poor.” They live in a magnificent house but can’t afford furniture or a vacation because 60% of their income goes to the mortgage.

- The 50/50 Adjustment: In these countries, the “Save” portion of the rule often needs to be aggressively directed into offset accounts (Australia) or ISAs (UK) to build liquidity, rather than just dumping it all into the house.30

India & Asia: The Wedding and Gold Tax

In many Asian cultures, lifestyle creep is communal.

- The Mechanism: As your income rises, your family’s expectations of you rise. You are expected to host lavish weddings, buy gold for relatives, or support extended family members.

- The “Status” Creep: There is also immense pressure to buy branded goods (Apple, Gucci) to prove that your education and job were “worth it.”

- The 50/50 Adjustment: The “Spend” portion here might need to include a “Family Obligation Fund.” You can spend on the family, but it must come from the 50% spend bucket, not the savings bucket. It forces boundaries.11

The United States: The Convenience Culture

In the US, creep is often about “outsourcing.”

- The Mechanism: “I’m too busy to cook, I’ll order UberEats.” “I’m too busy to clean, I’ll hire a maid.” “I’m too busy to walk the dog, I’ll hire a walker.”

- The Consequence: You bleed money on services.

- The 50/50 Adjustment: Review these recurring service costs. Are they actually buying you time that you use to earn money? Or are they just buying you time to watch Netflix?.31

Chapter 7: The Future You

Let’s fast forward twenty years.

Scenario A: Elias continues on the Treadmill.

He is 55 years old. He is a Senior Partner. He makes $300,000 a year. He lives in a $2 million house. He drives a $100,000 car. He looks like a titan of industry.

But he has $50,000 in savings.

He cannot stop working. If he stops, the house is gone, the car is gone, the club membership is gone. He is a slave to his paycheck. He has “Golden Handcuffs.” He is stressed, tired, and terrified of ageism in his industry because he has no exit plan.

Scenario B: Elias adopts the 50/50 Rule (Starting Today).

He is 55. He makes $300,000 a year. He lives in a nice, but modest, apartment. He drives a 5-year-old Volvo.

But he has $2.5 million in his brokerage account (thanks to saving 50% of every raise for the last 20 years).

He goes into work because he wants to, not because he has to. If the boss annoys him, he can quit. If he wants to take a sabbatical to paint, he can.

He owns his time.

This is the ultimate lesson. Wealth is not about what you buy. Wealth is about the freedom you keep.

The car is not wealth. The car is a liability.

The savings account is wealth. The savings account is options.

Chapter 8: Data & Tables

To visualize the impact, let’s look at the raw data.

Table 1: The “Lifestyle Creep” Impact on Retirement

Assumptions: Starting Salary $50k, 20 years to retirement, 5% annual raises, 7% investment return.

| Strategy | % of Raise Saved | % of Raise Spent | Final Annual Lifestyle Cost | Portfolio Value at Year 20 | Years of Freedom Bought |

| The Spender (Elias) | 0% | 100% | $132,665 | $100,000 | < 1 Year |

| The Saver (Sarah) | 50% | 50% | $91,332 | $640,000 | 7 Years |

| The Super Saver | 75% | 25% | $70,665 | $910,000 | 12.8 Years |

Analysis:

- The Spender: Ends up with a very expensive life ($132k/year cost) and almost no money to support it. He is doomed to work forever.

- The Saver (50/50): Has a very comfortable life ($91k is nearly double the starting lifestyle!) but has amassed a massive nest egg. This strikes the perfect balance.

- The Super Saver: Has the most freedom, but lives a tighter life. This is for people who want to retire extremely early (FIRE movement).

Table 2: The Psychology Checklist

Use this to diagnose your own spending.

| Symptom | Diagnosis | Treatment |

| “My old car looks like junk now that I got a promotion.” | Hedonic Adaptation | Wait 3 months. Your brain will normalize. The urge will fade. |

| “I need a new watch because everyone at the partner meeting had one.” | Social Comparison | Recognize that their watches might be bought on credit. Don’t compete with debt. |

| “I deserve this vacation because I worked hard.” | Mental Accounting | You do deserve it! But pay for it from the 50% “Spend” bucket, not by dipping into savings. |

| “I bought the new couch, now I need the new rug.” | Diderot Effect | Stop the chain. Keep the old rug. Embrace the mismatch as a badge of financial discipline. |

Epilogue: Breaking the Cage

Elias put down his phone. The text from Sarah was still on the screen. “Save 50, Spend 50.”

He looked at the credit card bill on the counter. He couldn’t pay it off fully this month. That was the reality. But he looked at the calendar. December 15th. Bonus day was coming.

He grabbed a sticky note and wrote on it: “THE FREEDOM FUND.”

He stuck it to his computer monitor. When the bonus check came—a hefty $15,000—he didn’t look at car upgrades. He didn’t look at vacations. He walked into the bank the next morning.

“I’d like to open a separate high-yield savings account,” he told the teller.

“How much would you like to deposit?”

“$7,500,” Elias said. Exactly 50%.

He took the other $7,500 and paid off his credit card debt. He bought a nice bottle of wine—not the $200 bottle, but a decent $40 bottle. He went up to his apartment, sat on his balcony, and drank it.

The view was the same. The furniture was the same. But for the first time in three years, the knot in his stomach was gone.

He wasn’t running on the treadmill anymore. He had stepped off. And finally, watching the sun set over the city he helped build, Elias felt rich.

Deep Dive: Additional Considerations for the Reader

1. The Role of Credit Cards

We must address the enabler of lifestyle creep: Credit.

Credit cards are dangerous because they separate the pleasure of buying from the pain of paying. When Elias bought the furniture, he swiped a piece of plastic. It didn’t hurt. He got the furniture immediately. The pain (the bill) didn’t arrive for 30 days.

- Psychological Trick: This time gap tricks the brain into thinking the item was free. By the time the bill comes, the dopamine from the purchase is gone, and you are just left with the debt.

- The Fix: If you are struggling with creep, switch to Debit or Cash for variable expenses. When you hand over cash, the “pain center” in your brain lights up. You feel the loss. It acts as a natural brake on spending.31

2. The “Subscription Economy”

Companies have weaponized lifestyle creep through subscriptions.

- In the past, you bought a movie for $20. You felt it.

- Now, you subscribe to Netflix for $15/month. It feels like nothing.

- But then you add Hulu, Disney+, HBO, Spotify, Gym, iCloud, Amazon Prime, Blue Apron, BarkBox.

- Suddenly, you have $400/month in “fixed” costs that leave your account automatically. You don’t even decide to spend it; it just vanishes.

- The Fix: Audit your subscriptions every 6 months. Cancel anything you haven’t used in 30 days. Be ruthless.4

3. The “Treat Yourself” Culture

Social media (Instagram, TikTok) constantly tells us to “Treat Yo Self” as a form of self-care.

- “You had a bad day? Buy the shoes.”

- “You had a good day? Buy the drink.”

- This frames spending as emotional regulation.

- The Truth: Real self-care is not being stressed about money. Real self-care is having an Emergency Fund so that if you get fired, you don’t lose your house. Prioritize financial self-care over retail self-care.32

4. Why “More Money” Doesn’t Fix Money Problems

Many people think, “If I just made more money, I wouldn’t have these problems.”

Elias proves this is false.

- If you cannot manage $50,000, you cannot manage $500,000.

- Money is a magnifier. If you have bad habits, more money will just make your bad habits bigger. (Instead of buying too many $20 shirts, you will buy too many $200 shirts).

- You must fix the habit (the software), not just the income (the hardware).10

The 50/50 rule is the software patch you need. It acknowledges that you are human and want to spend, but it forces you to act like a responsible CFO of your own life.

5. Start Today

You might be thinking, “I’ll start this when I get my next big raise.”

Do not wait.

Even if you don’t have a raise coming, you can apply the principle to “found money.”

- Tax refund? Save 50%, Spend 50%.

- Birthday money? Save 50%, Spend 50%.

- Sold an old item on eBay? Save 50%, Spend 50%.

Build the muscle now with small amounts. When the big money comes, the muscle memory will be there to save you.

Elias learned the hard way. You don’t have to. The calculator is in your hands. The rule is in your head. The freedom is waiting.

Works cited

- What is Lifestyle Creep? – Dark Horse Financial, accessed December 3, 2025, https://darkhorsefinancial.com.au/articles/what-is-lifestyle-creep/

- Lifestyle creep – Wikipedia, accessed December 3, 2025, https://en.wikipedia.org/wiki/Lifestyle_creep

- Lifestyle Inflation: What It Is, How It Works, and Example – Investopedia, accessed December 3, 2025, https://www.investopedia.com/terms/l/lifestyle-inflation.asp

- Understanding Lifestyle Creep | First Financial Bank, accessed December 3, 2025, https://ffin.com/articles-financial-education/understanding-lifestyle-creep

- What the Retirement Calculator Doesn’t Tell You – Schmitt Wealth Advisers, accessed December 3, 2025, https://schmittwealthadvisers.com/what-the-retirement-calculator-doesnt-tell-you/

- Americans aren’t saving as much as they used to | USAFacts, accessed December 3, 2025, https://usafacts.org/articles/why-arent-americans-saving-as-much-as-they-used-to/

- What is Lifestyle Creep & How to Avoid It [2025 Guide] – AdvisorFinder, accessed December 3, 2025, https://advisorfinder.com/blog-posts/what-is-lifestyle-creep-how-to-avoid-it-2025

- Lifestyle Creep: What It Is and How To Avoid It | Stash Learn, accessed December 3, 2025, https://www.stash.com/learn/how-to-avoid-lifestyle-creep/

- Could “lifestyle creep” affect your retirement plans? – JWA Financial Planning Ltd, accessed December 3, 2025, https://www.jwafinance.co.uk/could-lifestyle-creep-affect-your-retirement-plans/

- How lifestyle inflation, not low income, is hurting your savings? Explains expert, accessed December 3, 2025, https://www.indiatoday.in/business/personal-finance/story/how-lifestyle-inflation-not-low-income-is-hurting-your-savings-explains-expert-2828755-2025-12-01

- Lifestyle Inflation and Addictive Consumption – Dynamics and Function among Urban Youth in Indian Metropolis – IJBMI, accessed December 3, 2025, https://www.ijbmi.org/papers/Vol(9)8/Ser-2/A0908020109.pdf

- Hedonic adaptation: what it is and how to avoid it – Ailuna, accessed December 3, 2025, https://ailuna.com/hedonic-adaptation

- The Neurotic Treadmill: Decreasing Adversity, Increasing Vulnerability? – Payton Jones, accessed December 3, 2025, https://www.paytonjjones.com/publication/dissertation/Jones_Dissertation_Neurotic_Treadmill_Open_Access.pdf

- Understanding the Diderot Effect (and How To Overcome It) – Becoming Minimalist, accessed December 3, 2025, https://www.becomingminimalist.com/diderot/

- The Diderot Effect: Why We Want Things We Don’t Need — And What to Do About It | by James Clear | Personal Growth, accessed December 3, 2025, https://medium.com/personal-growth/the-diderot-effect-why-we-want-things-we-dont-need-and-what-to-do-about-it-3b8d49ea968f

- Understanding the Diderot Effect can simplify your life – Boomer Eco Crusader, accessed December 3, 2025, https://boomerecocrusader.com/what-to-do-about-the-diderot-effect/

- The Surprising Ways the Diderot Effect Impacts Your Spending Habits – MooreMomentum, accessed December 3, 2025, https://mooremomentum.com/blog/the-surprising-ways-the-diderot-effect-impacts-your-spending-habits/

- What The Tech Is Lifestyle Creep? – Level Up Financial Planning, accessed December 3, 2025, https://www.levelupfinancialplanning.com/what-the-tech-is-lifestyle-creep/

- Keeping up with the Joneses – Wikipedia, accessed December 3, 2025, https://en.wikipedia.org/wiki/Keeping_up_with_the_Joneses

- What is the synonym of “keeping up with the Joneses”? – Quora, accessed December 3, 2025, https://www.quora.com/What-is-the-synonym-of-keeping-up-with-the-Joneses

- Don’t Save 10% Of Income, Spend (Just) 50% Of Every Raise – Kitces.com, accessed December 3, 2025, https://www.kitces.com/blog/dont-save-10-of-income-spend-just-50-of-every-raise-and-systematically-save-more-tomorrow/

- Lifestyle creep explained: Monitor spending and splurges – Empower, accessed December 3, 2025, https://www.empower.com/the-currency/life/lifestyle-creep

- Combat Lifestyle Creep and Boost Retirement Savings – 401k Specialist, accessed December 3, 2025, https://401kspecialistmag.com/control-lifestyle-creep-through-retirement-saving/

- I don’t know what I’m doing and I may have chased away the help : r/Fire – Reddit, accessed December 3, 2025, https://www.reddit.com/r/Fire/comments/1nihngo/i_dont_know_what_im_doing_and_i_may_have_chased/

- From Guilt to Growth: Rewriting Your Money Story | Episode, accessed December 3, 2025, https://moneyguy.com/episode/chelsea-and-lucas/

- 50/15/5: An easy trick for saving and spending – Fidelity Investments, accessed December 3, 2025, https://www.fidelity.com/viewpoints/personal-finance/spending-and-saving

- Rework Your Budget Calculator – FNBO, accessed December 3, 2025, https://www.fnbo.com/tools-resources/calculators/personal/rework-your-budget

- How to Avoid Lifestyle Creep – Dark Horse Financial, accessed December 3, 2025, https://darkhorsefinancial.com.au/articles/how-to-avoid-lifestyle-creep/

- The Effects of Lifestyle Creep and Ways to Manage It – SoFi, accessed December 3, 2025, https://www.sofi.com/learn/content/effects-of-lifestyle-creep/

- Eight Ways To Combat Lifestyle Inflation | Infinity Financial Solutions, accessed December 3, 2025, https://www.infinitysolutions.com/blog/eight-ways-to-combat-lifestyle-inflation/

- 8 Ways to Avoid the Lifestyle Creep Trap – Verywell Mind, accessed December 3, 2025, https://www.verywellmind.com/lifestyle-creep-8667848

- The Psychology of Spending: How Emotions Shape Our Financial Decisions – EFL Global, accessed December 3, 2025, https://www.eflglobal.com/the-psychology-of-spending-how-emotions-shape-our-financial-decisions/

- The Psychology of Emotional Spending, accessed December 3, 2025, https://www.psychologytoday.com/us/blog/mental-wealth/202305/the-psychology-of-emotional-spending