Personal Spending

-

The ‘No-Hangover’ Holiday: Surviving Without a Credit Card

It usually happens around January 14th. The decorations are down, the tree is mulched, and the festive glow has faded into the grey reality of mid-winter. Then, it arrives in your inbox or mailbox: the credit card statement. For millions of people, this moment brings a physical sinking feeling—the “Financial Hangover.” We tend to treat

-

The “Habit Stacking” Method: How to Automate Your Financial Wins

You don’t need more motivation. You need a better system. Here’s how to “stack” a new money habit onto a daily routine you already do. Part 1: The 11 PM Budget Panic: Why Your Financial Plan Keeps Failing It’s 11:00 PM on a Tuesday. You’re in bed, scrolling on your phone, when a familiar, low-grade

-

The Doom Spenders

Part I: The 3 AM Cart It is 3:00 AM, and the only light in the room comes from the phone. For Munira, a nursing student, this blue-white glow has become a familiar, anxious companion.1 She is the daughter of immigrants who arrived in Canada with the promise of a better future, a promise she

-

The Great Global Standoff: High-Interest Froze the World

In the fall of 2024, the open houses went quiet. On a suburban street outside London, a “For Sale” sign that would have triggered a bidding war three years earlier now sat untouched. In New York, a young professional stared at mortgage calculations that had become a mathematical impossibility. This wasn’t the fiery crash many

-

The “Buy Now, Pay Later” Hangover

It begins with a click. A shopper—let’s call her Sarah—is at a digital checkout. A $200 pair of sneakers has been in her cart for a week. It’s a splurge, and the single-line item is daunting. She hesitates. But then, a magical option appears just below the total: “Or 4 interest-free payments of $50”.1 It

-

Introduction: The “Loyalty Penalty” and How to Beat It

Let’s be honest. That feeling of checking your bank account and seeing the automatic withdrawals—internet, phone, insurance, a dozen subscriptions—can feel like “death by a thousand cuts.” We all know the drill. When you first sign up for a service, you get a fantastic introductory price. But providers often count on you not checking how

-

The “I Deserve It” Trap (And How to Treat Yourself for Free)

You’ve worked hard. You’ve been good. You deserve a reward. But what if the “treat” you’ve been sold is really a trap? Here’s how to break the cycle, redefine your reward, and reclaim your well-being—without spending a dime. Section 1: The Click It is 11:30 PM on a Thursday. Alex, a composite of the modern,

-

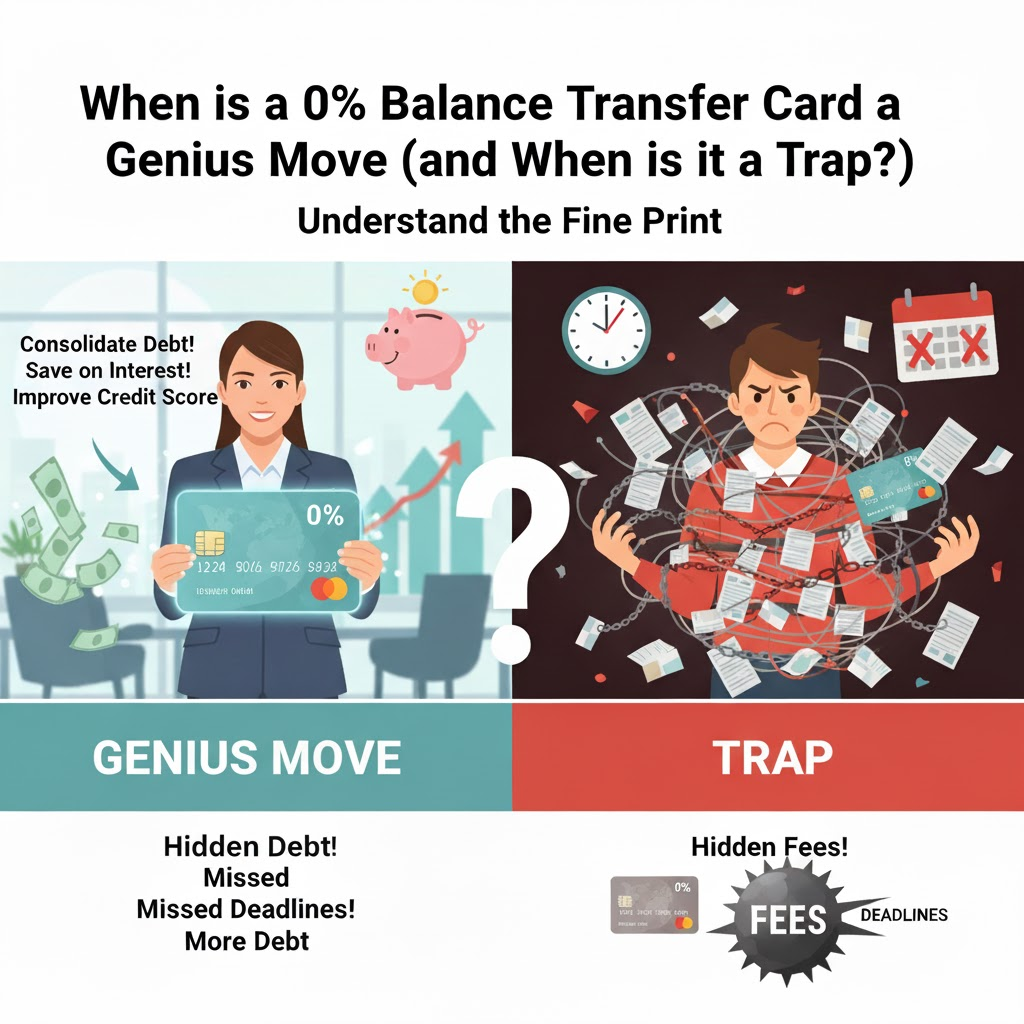

0% Balance Transfer Card a Genius Move Or is it a Trap?)

Part 1: The Treadmill and the Temporary Off-Ramp A. The “Debt Treadmill” Narrative For millions, high-interest credit card debt is not just a financial line item; it is a psychological burden. It can feel like financial quicksand—the more one struggles, the deeper one sinks.1 This experience is often described as the “debt treadmill”.2 The narrative

-

Building Your ‘Purpose Fund’: Saving for What Actually Matters

Part 1: The ‘Financial Checkmate’ and the Emptiness of Saving Section 1.1: The Narrative Hook: The ‘Perfect Budgeter’ Paradox Let’s tell a story you might find familiar. Meet Sarah. By every metric, Sarah is a financial superstar. She uses a budgeting app, just like the experts recommend.1 She meticulously tracks her spending, categorizing every coffee