Personal Spending

-

Your Personal P&L: Why Income is Vanity, but Cash Flow is Sanity

Most people obsess over their salary (Revenue). Try to learn the art of obsessing over what is left over (Net Income).

-

Run Rate: How to Predict Your Financial Future

The concept of “Run Rate.” If you spent $500 on groceries this week, you are on a “Run Rate” of $26,000/year.

-

The ‘Lifestyle Creep’ Calculator: Why Your Raise Didn’t Make You Richer

The Golden Cage: A Tale of Two Architects The elevator doors chimed with a polite, expensive-sounding ping, opening directly into the penthouse lobby. Elias adjusted his tie in the mirrored reflection of the steel doors. It was a new tie, silk, imported from Italy. It cost more than his first car payment. But that was

-

The Hourly Wage Test: Is That New Shirt Worth 4 Hours of Work?

Part I: The Awakening at the Register The Shirt and the Stare The fluorescent lights of the department store hummed with a quiet, hypnotic energy, casting a sterile glow over rows of neatly folded fabric. Leo stood in the center of the menswear section, his fingers brushing against the crisp cotton of a navy-blue button-down

-

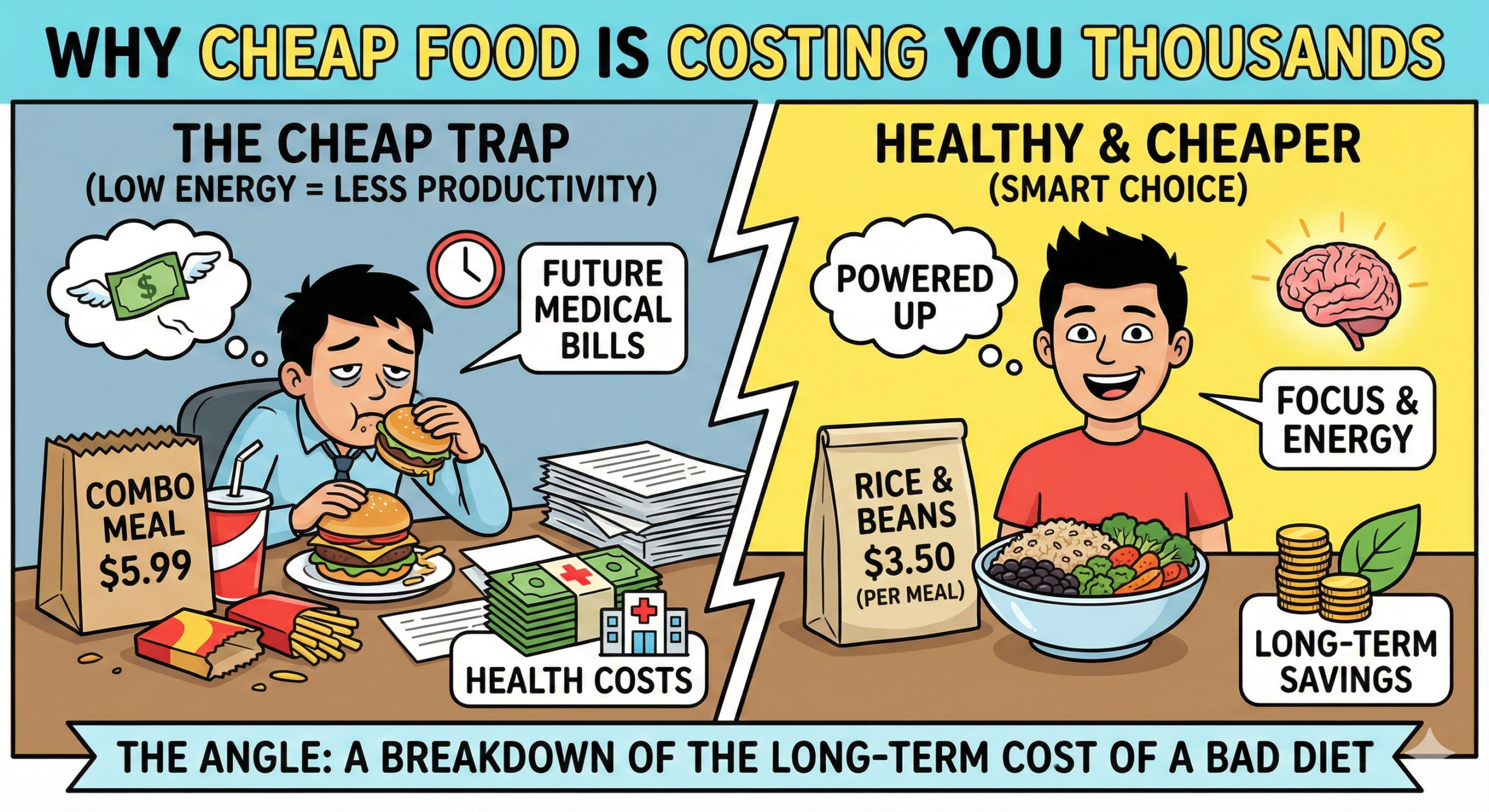

The ‘Fast Food’ Paradox: Why Cheap Food is Costing You Thousands

Part I: The Tale of Two Trajectories The alarm buzzed at 6:30 AM in two different apartments, signaling the start of a Tuesday that would look remarkably similar on the surface, but vastly different underneath. In apartment 4B, Arthur woke up feeling like he hadn’t slept at all. His head was heavy, a sensation he

-

The ‘Cost’ of Your Clutter: What Your Stuff is Actually Costing You

Introduction: The Tenant That Pays No Rent Elias stood in the center of his living room, a ceramic mug of lukewarm coffee warming his palms, staring at the beast. It was black, sleek, and occupied a prime piece of real estate near the floor-to-ceiling window that overlooked the grey, rain-slicked city skyline. It was a

-

Checkmate Your Debt: 3 Grandmaster Strategies Applied to Money

Prologue: The Zugzwang of Daily Life The rain in the city did not wash things clean; it merely made the grime slicker, reflecting the neon signs of payday lenders and pawn shops like distorted hallucinations. For Elena, the dampness seeped through the soles of her worn boots, a cold reminder of the choices she couldn’t

-

Shrinkflation: Why Your Groceries are Getting Smaller

I. The Case of the Vanishing Chips It began on a Tuesday, the sort of nondescript weekday that usually blurs into the rhythm of routine. Sarah stood in aisle four of her local supermarket, the fluorescent lights humming overhead with a sterile, flickering persistence that felt like a headache waiting to happen. In her hand,

-

Remittances: The Hidden Budget Item for Millions

Introduction: The Saturday Morning Queue The rain in Queens, New York, was not the cleansing kind; it was a cold, gray drizzle that seeped into the bones of the city, dampening the spirits of the early morning commuters on Roosevelt Avenue. Inside the cramped bodega, sandwiched between a discount electronics store and a bakery smelling